The onset of the pandemic made 2020 a year of rapid change and reactivity. 2021 rebounded with a year of initiative. Broadband availability surged into national headlines, communication service providers (CSPs) continued to innovate with 5G and wireless technologies, and consolidation activity was hot – these trends and more kept the communications sector busy in 2021. As always, we take a moment to comment on the major activities over the past year and forecast the trends that will drive 2022.

2021: The Year That Was

Infrastructure Funding

Pandemic lockdowns raised the stakes for home internet. One year later, our reliance on home internet remains at an all-time high. Not everyone, though, has benefitted from this “digital revolution.” As pandemic effects linger, these gaps are impossible to ignore. In 2021, governments in the US, UK, and elsewhere continued pushing ambitious goals to address broadband inequity.

More than 30 million Americans live in areas with less-than-acceptable broadband coverage. In November, President Joe Biden signed into law an infrastructure bill that included a $65 billion allocation for broadband, the largest federal investment in the sector to date[1]. The majority of that funding ($42.5 billion) is earmarked for states under the Broadband Equity, Access and Deployment Program (BEAD). BEAD provides grant support to broadband developers in rural locations and traditionally underserved areas[2], requiring a minimum download speed of 100 Mbps[3].

The massive amount of BEAD funding follows other federal broadband support, including the Rural Digital Opportunity Fund ($20 billion)[4] and the American Rescue Plan Act pandemic relief funds ($10 billion for broadband of $350 billion total)[5].

The US isn’t the only nation focused on expanding broadband. In March, the UK government launched “Project Gigabit,” a £5 billion initiative promising to connect homes and businesses with gigabit broadband. The plan provides a mix of direct infrastructure funding and consumer vouchers to promote fiber deployment in rural areas at risk of exclusion from commercial build.

Much like the US infrastructure bill, Project Gigabit will help people in eligible areas with no or slow broadband upgrade to faster connections[6]. Unlike the US, however, minimum speed thresholds are significantly faster (1Gbps vs 100 Mbps), raising questions about whether the US approach is sufficiently future-proof.

Project Gigabit is well on its way, with over 60% of homes and businesses now estimated to have access to gigabit speeds[7]. Most of this progress rides on the back of VMO2’s cable network upgrades, plus accelerating FTTH builds from Openreach and CityFibre. The rural funding program has slipped (contracts won’t be awarded until mid-2022 at the earliest), but the Government maintains that it is still on track for 85% gigabit coverage by 2025[8].

The expanding reach of broadband connectivity also helps companies that benefit from reliable, high-speed connection reach new customers. The addressable market for companies who offer HD streaming services, online gaming, music streaming, and other bandwidth-intensive services will increase as high-speed rollouts continue.

![]()

Consolidation and M&A

Telecom-related M&A activity centered on two objectives in 2021: recognizing value from infrastructure assets and using sale proceeds to fund strategic growth. Several CSPs looked to expand broadband coverage, selling assets to fund organic expansion and acquire other networks’ footprints. These divestitures included businesses adjacent to core telecom services. 2021 was a busy year – here’s a recap of the most significant action.

In 2021, Lumen Technologies (CenturyLink) raised over $10 billion, selling its Latin America business to Stonepeak and ILEC coverage in 20 states to Apollo[9]. The divested ILEC operations passed fewer than 10% of the ~2.4 million fiber enabled locations in the retained markets. With the capital raised from these transactions, Lumen repurchased shares and is focusing on accelerating fiber deployment, increasing its fiber build from 400K locations per year to 1 million in 2022 and 1.5+ million in 2023 and beyond[10]. Apollo, meanwhile, will invest $2 billion over the next five years to expand the fiber footprint of the acquired markets (rebranded as Brightspeed) with a target of 3 million locations[11]. WideOpenWest (WOW) engaged in a pair of similar transactions, selling off service areas to Atlantic Broadband and Astound Broadband. WOW now has greater financial flexibility to grow through investment in edge and greenfield expansion[12].

AT&T announced two major divestitures in 2021: the sale of a stake in DIRECTV and the spin-off plus combination of WarnerMedia with Discovery Inc. These transactions lowered AT&T’s leverage to ~2.6x and allow AT&T to re-focus on growth investment in core business: 5G mobility and fiber networks[13]. DIRECTV and the new WarnerMedia & Discovery company remain focused on media services.

In Europe, Tele2 and Deutsche Telekom agreed to sell T-Mobile Netherlands to Apax Partners and Warburg Pincus. The sale will finalize Tele2’s international consolidation and allow Tele2 to focus on core strategic operations in Sweden and the Baltics[14]. Deutsche Telekom boosted its US presence by using net proceeds from this deal to increase its stake in T-Mobile US via a $7 billion share swap deal with Softbank[15].

Orange SA’s Belgium subsidiary, Orange Belgium, announced in November that it had entered into exclusive negotiations with Nethys for the acquisition of VOO SA[16]. The addition of VOO’s cable network will expand Orange Belgium’s nationwide presence. French peer Iliad SA has also been active, announcing a deal with US-based Liberty Global to buy UPC Poland for $1.8 billion. The UPC deal complements Iliad’s recent acquisition of Play, making it the second largest telecom player in Poland[17].

Unlike the US, most tower sites in Europe are still owned by mobile operators. That may change quickly: recent deals illustrate tremendous growth in the market value of tower assets, with multiples topping 30x core earnings. CSPs are evaluating the strategic value of tower assets versus the immediate opportunity to cash in and pay down debt or buy-back shares[18]. Telefónica started 2021 with a spark, selling Telxius Towers’ sites across Europe and Latin America to American Tower for $9.4 billion[19]. Two months later, Vodafone spun off its towers unit, raising $2.7 billion from the public listing of Vantage Towers and using proceeds to pay down debt[20]. More growth-focused acquisitions include Spanish tower specialist CSP Cellnex Telecom SA expanding its European tower presence through the acquisitions of Hivory SAS[21] and CK Hutchison’s assets in Austria, Ireland, and Denmark[22].

European CSPs have attracted private equity investment due to their favorable valuations relative to North American peers[23]. With less scope to amass market power in a highly fragmented and competitive market, European telecoms stock typically command a lower multiple compared to US counterparts. For example, the STOXX Europe 600 Telecommunications index trades at ~5.8x EV / EBITDA while AT&T and T-Mobile trade at EV / EBITDA multiples greater than 7.0x.

In November, KKR announced a bid to purchase Telecom Italia at a valuation of ~5.2x EV / 2021 EBITDA[24]. Altice Europe purchased a 12.1% minority interest in British Telecom (BT) Group in June at an ~5.5x EV / EBITDA[25]. Altice’s CEO Patrick Drahi is known for making long-term value investments within the telecom space, and some have interpreted this investment as support for an aggressive plan to deliver FTTP to 25M homes by December 2026[26]. However, Altice have now raised their stake in BT to 18%, raising fears of a foreign takeover bid[27].

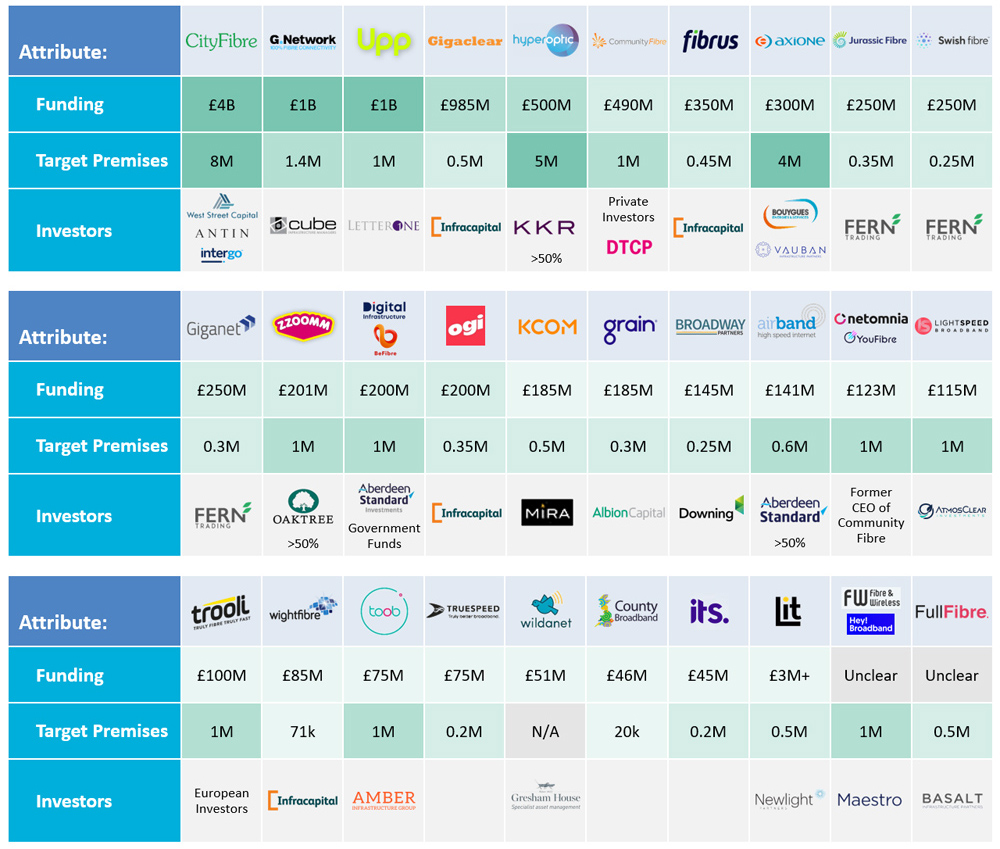

UK “AltNet” Market Overview (non-exhaustive)

One of the biggest investment stories in the UK is the continued rise of alternative network operators (“AltNets”) backed by private investors. In September, CityFibre made the news with a $1+ billion equity raise and later announced that it had passed the milestone of 1 million premises ready for service[28]. Meanwhile the number of new entrants keeps growing and now exceeds 100 – many supported in part by the Government’s voucher scheme.

Cartesian analysis suggests that FTTH plans from UK CSPs amount to roughly 2.5x the number of UK households – it’s clear that consolidation is on the horizon. We are closely tracking over 30 AltNets as they roll out fiber, measuring their pace and looking out for signs of overbuild. Amid this goldrush, it’s clear there will be winners and losers and we expect some firms will struggle as competition bites.

![]()

5G Update

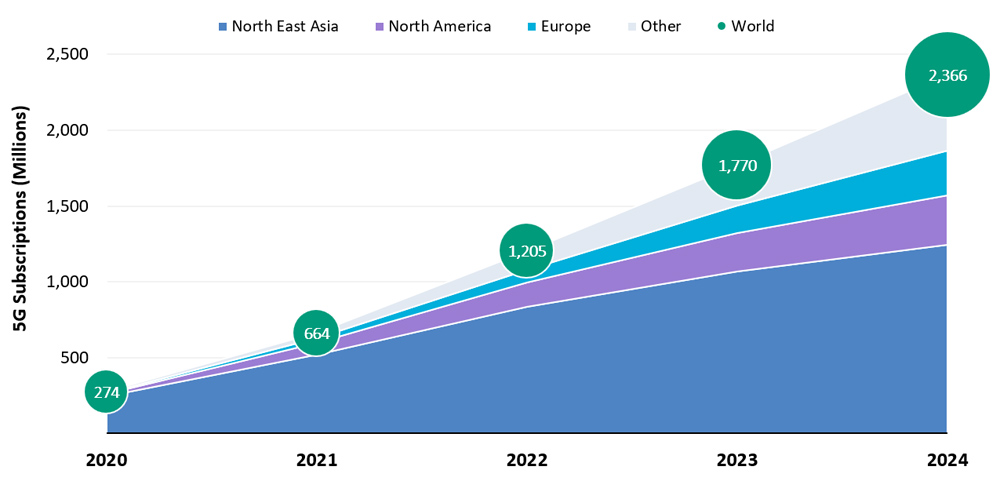

According to Kagan’s global 5G survey results, nearly two-thirds of surveyed MNOs claimed that Covid-19 hampered their 5G rollout plans throughout 2021[29]. The postponement of several mid-band spectrum auctions in late 2020 had repercussions on network expansion down the line, especially in the EU[30]. CSPs globally had to cope with supply chain uncertainty due to the extended chip shortage, and many planned steps in 5G innovation have been deferred to 2022[31].

In spite of these headwinds, global 5G subscriptions are expected to exceed 660 million by the end of this year[32]. China remains the largest market by volume, while South Korea leads with 40% availability rate and a startling median download speed above 400Mbps[33].

5G Mobile Subscriptions by Region

Source: Ericsson (November 2021)

In 2021, we saw 5G monetization hopes continue to revolve around enterprise solutions, a market that is projected to grow at a stunning CAGR of 30% over the next 7 years to reach a global value of $12.9 billion USD in 2028[34]. CSPs continued partnering with tech companies to develop state-of-the-art 5G B2B propositions leveraging advanced analytics and edge computing. Recent Verizon-AWS[35] and Telefonica Tech-Microsoft[36] agreements promise a continuation of this trend. We also saw a flurry of activity in private 5G networks, which enable new players to enter the mobile market without spectrum licenses. Notable examples include Nokia connecting Volkswagen’s manufacturing facility in Wolfsburg[37], Verizon’s work with ABP’s Port of Southampton in the UK[38], and Amazon’s preview of AWS Private 5G.

In the US, T-Mobile’s Ultra Capacity 5G network now covers 200 million people – hitting its 2021 target one month ahead of schedule – and plans to reach 300 million by 2023[39]. Nearby, Verizon and AT&T expanded their 5G footprints by investing $45 billion and $23 billion respectively in C-band wireless spectrum[40]. DISH Network is accelerating its 5G deployment plan started last year by striking new deals with major tower operators nationwide[41]. On the consumer front, 5G subscriptions will be around 59 million by the end of 2021 and are projected to increase by a 20% CAGR over the next several years[42].

As far as the UK is concerned, 5G deployment is still in its initial stages. The UK scores points off EU countries when it comes to 5G speed, but its 5G availability lags significantly behind the US. From a demand perspective, British customers so far appear to be skeptical about the value of 5G over the current 4G LTE proposition – according to the YouGov’s 2021 survey[43], just 16% of local respondents would be willing to pay a premium for 5G connectivity (versus a global average of 26%). Nevertheless, Ofcom raised £1.36 billion in March for the low- and mid-band spectrum auction – with EE and O2 taking the largest share[44] – and CSPs aim to ramp up their investments in 5G in the coming months.

![]()

Privacy and Security

CSPs have two principal concerns when it comes to privacy and security: protecting consumer data and restricting content to paying customers only. Not only are more resources being put towards data compliance and cybersecurity threats, CSPs are also being forced to react to the widespread problem of credential sharing and theft, especially within the OTT and TV market.

Leading the charge are OTT content providers focused on reducing piracy. Current activities include diagnosing the services that are most targeted by pirates and re-assessing safeguards accordingly. One such safeguard is geo-filtering – we anticipate stricter enforcement from content owners, which requires increasingly advanced technology as consumer adoption of VPNs increases (1 out of 3 internet users now has a VPN)[45]. On the studio side, Hollywood is increasingly promoting the use of watermarking technology as a fraud deterrent and a signal to track down pirates.

There is real opportunity here: an estimated 46 million streaming viewers do not currently pay for their service[46]. Streaming video providers have had to walk a fine line to enforce credential sharing policies without diminishing the user experience. As consumers become more aware and concerned over the protection and privacy of their personal data, verification options such as multi-factor authentication will become more palatable.

![]()

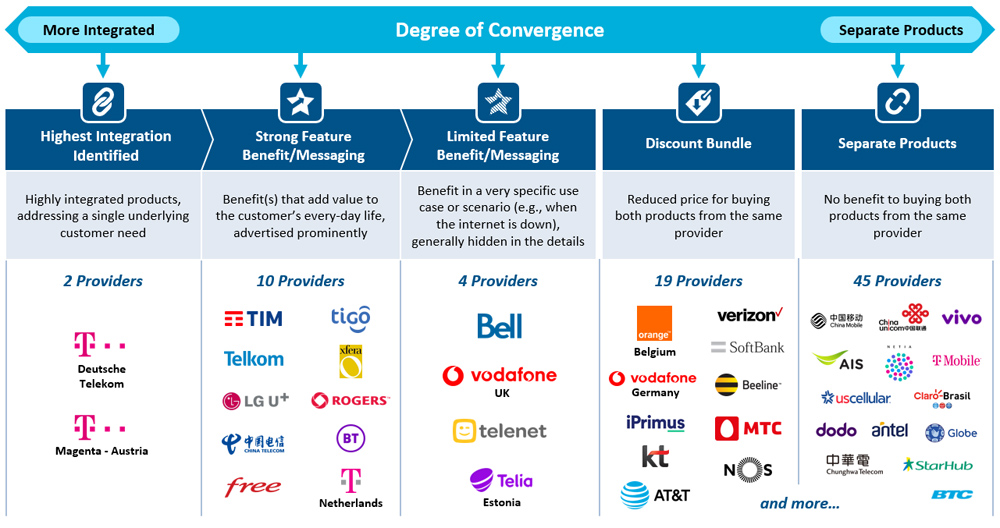

Fixed and Wireless Convergence

2021 has also seen renewed interest in fixed mobile convergence. The successful merging of Virgin Media and O2[47] created another converged network operator in the UK market, rivalling BT/EE. As broadband subscriber growth begins to plateau[48], attention has moved towards targeting the household to be the single provider of connectivity. “Fixed mobile bundling” and “converged households” are increasingly becoming core business KPIs for CSPs worldwide in a bid to unlock higher ARPU by cross-selling into old and new product categories. This of course comes with the added benefit of driving customer loyalty and reducing customer churn.

In the UK we saw further launches of “converged” services, with BT’s Halo proposition boosted by an “Unbreakable Broadband” promise. The promise combines a fixed BT broadband service and a mobile 4G Hub creating an “unbreakable” single network in the home. Vodafone launched its “Pro Broadband” package with a range of in-home and mobile benefits, and Virgin Media O2 impressively launched its cross-brand-and-product service Volt just 139 days after their official merger on 1st June[49], with benefits to match existing offers by BT/EE and Vodafone.

In the US we’ve also started to see how network convergence is providing additional value for customers, with mobile taking an increasing role in portfolios. Both Comcast and Charter started to aggressively price their mobile services, offloading traffic from the mobile network to Wi-Fi hotspots and passing this cost savings onto the consumer[50]. T-Mobile also launched its first truly unlimited mobile plan with no throttling, presenting “unlimited premium data” at a price level competitive with Verizon. 5G fixed wireless is also gaining traction with studies suggesting that it represents an efficient alternative to delivering high speed broadband to almost half of the rural households in the US.

Cartesian’s research found that Deutsche Telekom’s Magenta One in Germany still offers the highest integration of mobile and broadband. We expect the convergence and integration trend to continue in 2022. As the battleground has moved to monetizing existing customer relationships, CSPs will seek to not only drive further value creation, but also continued cost efficiencies from the integration and synergies between networks and systems.

Convergence definition = Synergies between products from the same CSP that result in an added value proposition when two or more of these products are bundled

Recap of 2021 Predictions: How’d we do?

1. Fiber investment will accelerate in Europe and the US, but rural hurdles will remain

![]() Did it happen? YES. Fiber investments have been substantial and the build out continues. Billions in government funding pushed the pace of investment across the US and UK. However, the last 10% of rural homes in the US still lack 25/3 speeds[51], and the UK is now looking out to 2030 to get close to 100%, citing challenges reaching rural homes[52].

Did it happen? YES. Fiber investments have been substantial and the build out continues. Billions in government funding pushed the pace of investment across the US and UK. However, the last 10% of rural homes in the US still lack 25/3 speeds[51], and the UK is now looking out to 2030 to get close to 100%, citing challenges reaching rural homes[52].

2. 5G consumer use cases will not prove game-changing (yet), so enterprise use cases will grow in importance

![]() Did it happen? YES. Despite modest growth in 5G mobile subscriptions[53], many consumers remain unconvinced that the upgrade is worth it. Use cases for ultra-low latency and high capacity continue to grow within the enterprise market, with MNOs developing private network offerings, edge computing, and advanced analytics.

Did it happen? YES. Despite modest growth in 5G mobile subscriptions[53], many consumers remain unconvinced that the upgrade is worth it. Use cases for ultra-low latency and high capacity continue to grow within the enterprise market, with MNOs developing private network offerings, edge computing, and advanced analytics.

3. 2021 will be the year that key questions around LEO are answered

![]() Did it happen? NOT QUITE. Key questions remain about LEO’s viability as a broadband, including whether they have adequate capacity to serve speeds that keep pace with the definition of broadband. Major players continue to push out timelines, including SpaceX announcing that Starlink wait times are now pushed to “late 2022, early 2023”[54].

Did it happen? NOT QUITE. Key questions remain about LEO’s viability as a broadband, including whether they have adequate capacity to serve speeds that keep pace with the definition of broadband. Major players continue to push out timelines, including SpaceX announcing that Starlink wait times are now pushed to “late 2022, early 2023”[54].

4. ISPs will seek to differentiate on in-home reliability

![]() Did it happen? YES. Remote work remained a key trend for 2021, putting a focus on robust in-home Wi-Fi solutions. New campaigns launched around Wi-Fi, such as BT/EE’s “unbreakable home wi-fi”[55] and Vodafone’s “super Wi-Fi”[56]. Comcast rebranded its xFi proposition during the pandemic (which has been heavily linked to its growth in subscribers and boost in ARPU)[57].

Did it happen? YES. Remote work remained a key trend for 2021, putting a focus on robust in-home Wi-Fi solutions. New campaigns launched around Wi-Fi, such as BT/EE’s “unbreakable home wi-fi”[55] and Vodafone’s “super Wi-Fi”[56]. Comcast rebranded its xFi proposition during the pandemic (which has been heavily linked to its growth in subscribers and boost in ARPU)[57].

5. Working from home changes will start to impact the enterprise telecoms market

![]() Did it happen? YES. The persistence of hybrid working models has pushed adoption of UcaaS, propelling significant market growth in the segment (expect a 19% CAGR until 2026[58]). Offices are investing in digital transformation tools, from “Zoom rooms” to enhanced cybersecurity, and disparate workforces are making companies rethink cloud computing strategies.

Did it happen? YES. The persistence of hybrid working models has pushed adoption of UcaaS, propelling significant market growth in the segment (expect a 19% CAGR until 2026[58]). Offices are investing in digital transformation tools, from “Zoom rooms” to enhanced cybersecurity, and disparate workforces are making companies rethink cloud computing strategies.

6. CSPs will face pressure to adopt digital service models

![]() Did it happen? YES.Covid-19 accelerated consumer demand for self-service, and CSPs are feeling the pressure. Many CSPs have invested in self-service channels such as chatbots, but struggle to route significant volumes of customer inquiry away from legacy channels. When utilized, self-service tools drive higher satisfaction and reduce customer service costs.

Did it happen? YES.Covid-19 accelerated consumer demand for self-service, and CSPs are feeling the pressure. Many CSPs have invested in self-service channels such as chatbots, but struggle to route significant volumes of customer inquiry away from legacy channels. When utilized, self-service tools drive higher satisfaction and reduce customer service costs.

7. Streaming markets will begin to shift to bundled offers

![]() Did it happen? YES. CSPs continued to provide streaming services to consumers through bundling them with core products, offering them as an add on and also as standalone bundles, such as Disney+/ Hulu/ ESPN+ with HBO Max/ Discovery+ expected soon. Notably in the UK TalkTalk has recently moved to a new partner model with Netflix, offering the subscription service built into their fiber broadband package[59].

Did it happen? YES. CSPs continued to provide streaming services to consumers through bundling them with core products, offering them as an add on and also as standalone bundles, such as Disney+/ Hulu/ ESPN+ with HBO Max/ Discovery+ expected soon. Notably in the UK TalkTalk has recently moved to a new partner model with Netflix, offering the subscription service built into their fiber broadband package[59].

8. Data science progress in TMT will continue to be made, but for large CSPs focus in 2021 will be on organizational readiness

![]() Did it happen? YES. Organizations have been active in the formation of data-specific teams but operational use cases remain limited. Massive, legacy organizations face challenges wrangling disparate data sources, controlling the costs associated with growing data infrastructure, and instilling the culture and skillsets required for data-driven decision making.

Did it happen? YES. Organizations have been active in the formation of data-specific teams but operational use cases remain limited. Massive, legacy organizations face challenges wrangling disparate data sources, controlling the costs associated with growing data infrastructure, and instilling the culture and skillsets required for data-driven decision making.

9. Fixed and mobile CSPs will continue to be taken private

![]() Did it happen? YES. The delisting of Altice Europe and Xavier Niel’s buyout of Iliad ($3.7 billion) fueled substantial buzz around delisting deals this year, culminating in KKR’s $12 billion bid for TIM.

Did it happen? YES. The delisting of Altice Europe and Xavier Niel’s buyout of Iliad ($3.7 billion) fueled substantial buzz around delisting deals this year, culminating in KKR’s $12 billion bid for TIM.![]()

10. Fixed-mobile consolidation to continue

![]() Did it happen? YES. Consolidation activity has brought new players to the fixed-wireless convergence conversation; Virgin Media O2 joins BT/EE in the UK, while in the US, T-Mobile continues to be aggressive since merging with Sprint. Mobile took an increasing role in product portfolios as CSPs offload traffic to Wi-Fi hotspots and pass lower costs onto consumers.

Did it happen? YES. Consolidation activity has brought new players to the fixed-wireless convergence conversation; Virgin Media O2 joins BT/EE in the UK, while in the US, T-Mobile continues to be aggressive since merging with Sprint. Mobile took an increasing role in product portfolios as CSPs offload traffic to Wi-Fi hotspots and pass lower costs onto consumers.

Recap of 2021 Predictions: How’d we do?

1. Fiber investment will accelerate in Europe and the US, but rural hurdles will remain

![]() Did it happen? YES. Fiber investments have been substantial and the build out continues. Billions in government funding pushed the pace of investment across the US and UK. However, the last 10% of rural homes in the US still lack 25/3 speeds[51], and the UK is now looking out to 2030 to get close to 100%, citing challenges reaching rural homes[52].

Did it happen? YES. Fiber investments have been substantial and the build out continues. Billions in government funding pushed the pace of investment across the US and UK. However, the last 10% of rural homes in the US still lack 25/3 speeds[51], and the UK is now looking out to 2030 to get close to 100%, citing challenges reaching rural homes[52].

2. 5G consumer use cases will not prove game-changing (yet), so enterprise use cases will grow in importance

![]() Did it happen? YES. Despite modest growth in 5G mobile subscriptions[53], many consumers remain unconvinced that the upgrade is worth it. Use cases for ultra-low latency and high capacity continue to grow within the enterprise market, with MNOs developing private network offerings, edge computing, and advanced analytics.

Did it happen? YES. Despite modest growth in 5G mobile subscriptions[53], many consumers remain unconvinced that the upgrade is worth it. Use cases for ultra-low latency and high capacity continue to grow within the enterprise market, with MNOs developing private network offerings, edge computing, and advanced analytics.

3. 2021 will be the year that key questions around LEO are answered

![]() Did it happen? NOT QUITE. Key questions remain about LEO’s viability as a broadband, including whether they have adequate capacity to serve speeds that keep pace with the definition of broadband. Major players continue to push out timelines, including SpaceX announcing that Starlink wait times are now pushed to “late 2022, early 2023”[54].

Did it happen? NOT QUITE. Key questions remain about LEO’s viability as a broadband, including whether they have adequate capacity to serve speeds that keep pace with the definition of broadband. Major players continue to push out timelines, including SpaceX announcing that Starlink wait times are now pushed to “late 2022, early 2023”[54].

4. ISPs will seek to differentiate on in-home reliability

![]() Did it happen? YES. Remote work remained a key trend for 2021, putting a focus on robust in-home Wi-Fi solutions. New campaigns launched around Wi-Fi, such as BT/EE’s “unbreakable home wi-fi”[55] and Vodafone’s “super Wi-Fi”[56]. Comcast rebranded its xFi proposition during the pandemic (which has been heavily linked to its growth in subscribers and boost in ARPU)[57].

Did it happen? YES. Remote work remained a key trend for 2021, putting a focus on robust in-home Wi-Fi solutions. New campaigns launched around Wi-Fi, such as BT/EE’s “unbreakable home wi-fi”[55] and Vodafone’s “super Wi-Fi”[56]. Comcast rebranded its xFi proposition during the pandemic (which has been heavily linked to its growth in subscribers and boost in ARPU)[57].

5. Working from home changes will start to impact the enterprise telecoms market

![]() Did it happen? YES. The persistence of hybrid working models has pushed adoption of UcaaS, propelling significant market growth in the segment (expect a 19% CAGR until 2026[58]). Offices are investing in digital transformation tools, from “Zoom rooms” to enhanced cybersecurity, and disparate workforces are making companies rethink cloud computing strategies.

Did it happen? YES. The persistence of hybrid working models has pushed adoption of UcaaS, propelling significant market growth in the segment (expect a 19% CAGR until 2026[58]). Offices are investing in digital transformation tools, from “Zoom rooms” to enhanced cybersecurity, and disparate workforces are making companies rethink cloud computing strategies.

6. CSPs will face pressure to adopt digital service models

![]() Did it happen? YES.Covid-19 accelerated consumer demand for self-service, and CSPs are feeling the pressure. Many CSPs have invested in self-service channels such as chatbots, but struggle to route significant volumes of customer inquiry away from legacy channels. When utilized, self-service tools drive higher satisfaction and reduce customer service costs.

Did it happen? YES.Covid-19 accelerated consumer demand for self-service, and CSPs are feeling the pressure. Many CSPs have invested in self-service channels such as chatbots, but struggle to route significant volumes of customer inquiry away from legacy channels. When utilized, self-service tools drive higher satisfaction and reduce customer service costs.

7. Streaming markets will begin to shift to bundled offers

![]() Did it happen? YES. CSPs continued to provide streaming services to consumers through bundling them with core products, offering them as an add on and also as standalone bundles, such as Disney+/ Hulu/ ESPN+ with HBO Max/ Discovery+ expected soon. Notably in the UK TalkTalk has recently moved to a new partner model with Netflix, offering the subscription service built into their fiber broadband package[59].

Did it happen? YES. CSPs continued to provide streaming services to consumers through bundling them with core products, offering them as an add on and also as standalone bundles, such as Disney+/ Hulu/ ESPN+ with HBO Max/ Discovery+ expected soon. Notably in the UK TalkTalk has recently moved to a new partner model with Netflix, offering the subscription service built into their fiber broadband package[59].

8. Data science progress in TMT will continue to be made, but for large CSPs focus in 2021 will be on organizational readiness

![]() Did it happen? YES. Organizations have been active in the formation of data-specific teams but operational use cases remain limited. Massive, legacy organizations face challenges wrangling disparate data sources, controlling the costs associated with growing data infrastructure, and instilling the culture and skillsets required for data-driven decision making.

Did it happen? YES. Organizations have been active in the formation of data-specific teams but operational use cases remain limited. Massive, legacy organizations face challenges wrangling disparate data sources, controlling the costs associated with growing data infrastructure, and instilling the culture and skillsets required for data-driven decision making.

9. Fixed and mobile CSPs will continue to be taken private

![]() Did it happen? YES. The delisting of Altice Europe and Xavier Niel’s buyout of Iliad ($3.7 billion) fueled substantial buzz around delisting deals this year, culminating in KKR’s $12 billion bid for TIM.

Did it happen? YES. The delisting of Altice Europe and Xavier Niel’s buyout of Iliad ($3.7 billion) fueled substantial buzz around delisting deals this year, culminating in KKR’s $12 billion bid for TIM.

10. Fixed-mobile consolidation to continue

![]() Did it happen? YES. Consolidation activity has brought new players to the fixed-wireless convergence conversation; Virgin Media O2 joins BT/EE in the UK, while in the US, T-Mobile continues to be aggressive since merging with Sprint. Mobile took an increasing role in product portfolios as CSPs offload traffic to Wi-Fi hotspots and pass lower costs onto consumers.

Did it happen? YES. Consolidation activity has brought new players to the fixed-wireless convergence conversation; Virgin Media O2 joins BT/EE in the UK, while in the US, T-Mobile continues to be aggressive since merging with Sprint. Mobile took an increasing role in product portfolios as CSPs offload traffic to Wi-Fi hotspots and pass lower costs onto consumers.

2022 Predictions: What comes next?

1. In 2022, European 5G roll-outs will accelerate, having so far lagged significantly behind the US and Asia. Private network activity will accelerate in countries that have reserved spectrum for this (e.g., UK, Germany), but it will be a small part of the whole.

2. Gigabit broadband will gain traction amongst early adopters as bandwidth requirements continue to grow. Take-up of 1Gbps services will increase as they start to become competitively priced vs. 200Mbps and 300Mbps offerings.

3. More MNOs will launch 5G offers as substitutes for fixed broadband, and the coverage of these services will accelerate.

4. As ESG considerations increase in importance to investors and climate policy discussions get louder, we will see an increased focus on the TMT sector’s total carbon emissions rather than unit-based metrics (e.g., CO2 per GB). The TMT sector will continue to lead as an enabler of carbon savings in other sectors, leveraging smart infrastructure to save energy.

5. Many new FTTP entrants will struggle to meet their roll-out and customer uptake targets. Significant overbuild competition and commercial fight-back from larger ISPs will force new entrants to operate at sub-scale, triggering the start of a market consolidation process.

6. TV will increasingly be delivered over IP through a mix of user experiences. These user experiences will take over as the new normal but there will be some friction with new products.

7. CSPs will grab headlines with the announcement of municipal partnerships aimed at developing “smart cities.”

8. Years of accelerated digital change have piled up legacy architecture quickly – faster than CSPs can remove it. CSPs will face continued delays in retiring legacy platforms, and costs from the incremental complexity will add up.

9. Net neutrality will be reinstated in the US, rolling back the FCC’s repeal of the Open Internet Order in 2015.

10. Streaming services that have enjoyed explosive growth since early 2020 will see subscriber adds stall. Early customer acquisition was boosted by promotional activity and partnerships, but these gains will plateau as more difficult customer acquisition coincides with a reduction in mid-pandemic consumption habits.

![]()

Do you agree with our predictions? What do you think 2022 will bring to the communications sector? Share your comments on our Year-End Letter with us.

![]()

Notes:

[1] Restuccia, Andrew, and Eliza Collins. “Biden Signs $1 Trillion Infrastructure Bill into Law.” The Wall Street Journal. Dow Jones & Company, November 15, 2021. https://www.wsj.com/articles/biden-infrastructure-bill-signing-11636997814?mod=article_inline

[2] Price, Sydney. “Infrastructure Bill Poses Opportunities, Challenges for Broadband Providers.” S&P Global, August 6, 2021. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/infrastructure-bill-poses-opportunities-challenges-for-broadband-providers-65834199

[3] de Wit , Kathryn. “Infrastructure Bill Passed by Senate Includes Historic, Bipartisan Broadband Provisions.” The Pew Charitable Trusts. Accessed December 14, 2021. https://www.pewtrusts.org/en/research-and-analysis/articles/2021/08/30/infrastructure-bill-passed-by-senate-includes-historic-bipartisan-broadband-provisions

[6] “Government Launches New £5bn ‘Project Gigabit’.” GOV.UK. Accessed December 3, 2021. https://www.gov.uk/government/news/government-launches-new-5bn-project-gigabit

[7] https://www.ofcom.org.uk/__data/assets/pdf_file/0035/229688/connected-nations-2021-uk.pdf

[8] “Project Gigabit Delivery Plan: Autumn Update.” GOV.UK. Accessed December 3, 2021. https://www.gov.uk/government/publications/project-gigabit-delivery-plan-autumn-update/project-gigabit-delivery-plan-autumn-update

[9] Lumen Technologies. (2021, August 3). Lumen Asset Transactions Overview

[10] Lumen Technologies. (2021). 2021 3rd Quarter Earnings Call Transcript

[11] Brightspeed. (2021, November 17). Brightspeed Announces Brand and Affirms Intention to Bring High-Speed Internet to Rural and Suburban Communities Throughout the United States

[12] WideOpenWest. (2021, December 9). 2021 Analyst / Investor Day

[13] AT&T. (2021, May 17). Discovery and WarnerMedia to Combine Investor Presentation

[14] Tele2. (2021, September 7). Tele2 and Deutsche Telekom Divest T-Mobile Netherlands

[15] Reuters – Busvine, D. & Kelly, T. (2021, September 7). Deutsche Telekom Lifts T-Mobile US Stake in SoftBank Swap Deal

[16] Reuters – Rosemain, R. & Kar-gupta, S. (2021, November 23). France’s Orange Aims to Add Belgian Fixed Line Through VOO Deal

[17] https://www.rcrwireless.com/20210922/business/iliad-adds-upc-poland-to-play-portfolio

[19] https://seekingalpha.com/news/3650972-american-tower-in-9_4b-deal-for-europes-telxius-towers

[20] https://telecoms.com/509057/vantage-towers-starts-trading-vodafone-makes-e2-3-billion/

[21] Cellnex. (2021, February 3). Cellnex Has Reached an Exclusivity Agreement to Acquire 100% of Hivory With a Portfolio of 10,500 Sites in France

[22] Cellnex. (2021, January 26) Cellnex Closes the Acquisition of CK Hutchison’s Assets in Sweden

[23] S&P Global – Calatayud, A. (2021, November 22). Private Equity Doesn’t Hang Up on European Telecoms – Market Insight

[24] S&P Global – Calatayud, A. (2021, November 22). Private Equity Doesn’t Hang Up on European Telecoms – Market Insight

[25] Altice UK. (2021, June 10). Altice UK Statement Regarding BT Group plc

[26] BT Group. (2021, May 13). BT to Increase and Accelerate FTTP Build to 25M Premises by End of 2026

[27] S&P Global – Morris, K. (2021, December 14). Altice UK Buys 585 Mln Further Shares in BT Group

[28] CityFibre. (2021, November 11). Vodafone anchors CityFibre’s nationwide Full Fibre rollout to 8 Million Homes

[29] S&P Capital IQ, “Global 5G Survey: Operators push past COVID-19 to accelerate 5G network upgrades,” [Online]. Available: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?KeyProductLinkType=2&id=67227198

[30] S&P Capital IQ, “Upcoming global spectrum auctions, 2021 onward,” [Online]. Available: https://www.capitaliq.spglobal.com/web/client?#news/article?KeyProductLinkType=2&id=62326792

[32] FT, “5G pushed back by pandemic,” [Online]. Available: https://www.ft.com/content/cd1abd3f-bc12-420b-b54c-fb76d9418cee

[32] Ericsson, “Ericsson Mobility Report,” [Online]. Available: https://www.ericsson.com/4ad7e9/assets/local/reports-papers/mobility-report/documents/2021/ericsson-mobility-report-november-2021.pdf

[33] Speedtest, “5G in the United Kingdom is Getting Faster and Boosting Consumer Sentiment,” [Online]. Available: https://www.speedtest.net/insights/blog/5g-united-kingdom-q1-q2-2021/

[34] Verified Market Research, “5G Enterprise Market Size And Forecast,” [Online]. Available: https://www.verifiedmarketresearch.com/product/5g-enterprise-market/

[35] AWS, “AWS and Verizon Expand 5G Collaboration with Private MEC Solution,” [Online]. Available: https://aws.amazon.com/blogs/industries/aws-and-verizon-expand-5g-collaboration-with-private-mec-solution/

[36] Telefonica, “Telefónica Tech partners with Microsoft to provide the industrial sector with private 5G connectivity and on-premises edge computing,” [Online]. Available: https://www.telefonica.com/en/communication-room/telefonica-tech-partners-with-microsoft-to-provide-the-industrial-sector-with-private-5g-connectivity-and-on-premises-edge-computing/

[37] 5G Radar, “Volkswagen launches pilot local 5G network for its production operations,” [Online]. Available: https://www.5gradar.com/news/volkswagen-launches-pilot-local-5g-network-for-its-production-operations

[38] Verizon, “Verizon signs its first European Private 5G deal with Associated British Ports,” [Online]. Available: https://www.verizon.com/about/news/verizon-european-private-5g-deal-associated-british-ports

[39] T-Mobile, “T‑Mobile’s Game‑Changing Ultra Capacity 5G Now Reaches 200 Million People Nationwide,” [Online]. Available: https://www.t-mobile.com/news/network/t-mobiles-game-changing-ultra-capacity-5g-now-reaches-200-million-people-nationwide

[40] S&P Capital IQ, “AT&T, Verizon 5G rollouts run into Federal Aviation Administration turbulence,” [Online]. Available: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?KeyProductLinkType=2&id=67489397

[41] S&P Capital IQ, “DISH signs 7 new tower deals for 5G,” [Online]. Available: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?KeyProductLinkType=2&id=62705372

[42] S&P Capital IQ, “US mobile projections through 2031,” [Online]. Available: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?id=67252395

[43] YouGov, “INTERNATIONAL TELCO REPORT 2021 – Consumer Adoption of 5G,” [Online]. Available: https://commercial.yougov.com/rs/464-VHH-988/images/International-Telco-Report-2021-Consumer-Adoption-of-5G.pdf

[44] ISPreview, “Preliminary Winners of Ofcom’s UK 5G Mobile Auction Revealed,” [Online]. Available: https://www.ispreview.co.uk/index.php/2021/03/preliminary-winners-of-ofcoms-uk-5g-mobile-auction-revealed.html

[45] https://surfshark.com/blog/vpn-users

[47] https://news.virginmediao2.co.uk/introducing-volt-the-new-supercharged-service-from-virgin-media-o2/

[50] https://ir.charter.com/financial-information/quarterly-results

[51] https://www.ncta.com/whats-new/new-fcc-data-highlights-americas-broadband-progress

[53] Ericsson, “Ericsson Mobility Report,” [Online]. Available: https://www.ericsson.com/4ad7e9/assets/local/reports-papers/mobility-report/documents/2021/ericsson-mobility-report-november-2021.pdf

[54] https://www.pcmag.com/news/spacex-pushes-wait-times-for-starlink-to-late-2022-early-2023-for-more

[55] https://www.bt.com/exp/halo?s_intcid=con_redirect_halo

[57] Analysis Mason, “Comcast’s success shows the power of a connectedhome-centric strategy” [PDF]