Poor economic conditions impacted all industries in 2023, and the Technology, Media, and Telecom (TMT) sector was no exception. Against a backdrop of continued high inflation, high energy costs, and a reduction in consumer spending power, many TMT players have refocused their efforts on core business offerings to drive growth. And while economic conditions have stalled some projects, others have continued to push ahead.

Good news can be found in fiber deployment, both in the US and Europe, which saw a 10% increase in coverage last year. For the large US cable operators, mobile services provided a welcome source of growth. And for content distributors, the resolution of the actors and writers’ strikes is a great relief.

Looking ahead, we are excited by the potential for AI to deliver transformational change in the industry. We’re already working with clients on use cases to improve customer experience and reduce costs and see this as just the beginning of a huge wave of progress and advancement.

2023: The Year That Was

Resilient market and investments upheld amidst challenging economic conditions

The TMT industry has faced its share of challenges over the past year. Inflation and rising energy costs remain a concern, exerting pressure on profit margins and contributing to overall economic uncertainty.

Despite these challenges, telecom services – considered essential by residential consumers – have proven to be resilient; many operators have posted positive results as tactical price adjustments have paid off and customer retention has remained stable. This strategic approach and consumers’ reliance on connectivity has allowed leading providers to sustain modest growth.

The importance of telecoms is supported by the global ambition to deploy fiber and broadband connectivity on a wider scale, with substantial government and private funding ensuring the continued strength of broadband initiatives. For instance, in the UK, the Government’s Project Gigabit has already allocated over £2 billion to broadband suppliers for the rollout of gigabit broadband to rural areas.[1] While in the U.S., $42.5 billion of BEAD funding has been allocated to states and territories by the NTIA, with the states now planning their individual funding programs.[2]

Elsewhere, TMT players have responded to the economic headwinds with cost-saving measures to streamline their operations. Significant workforce reductions have been announced by major operators such as Vodafone, T-Mobile US and most recently, Telefonica.[3]

While 2023 saw a slowdown in industry M&A activity – global telecoms deal value declined by 41% from H1 2022 to H1 2023 – there were notable instances of consolidation and infrastructure divestiture. Notably, Colt completed its $1.8 billion acquisition of Lumen’s EMEA business[4] and Telecom Italia approved the sale of its fixed-line network to US private equity firm, KKR.[5]

In the cell towers market, several Mobile Network Operators (MNOs) divested stakes in joint ventures as part of quick capital-raising efforts.[6] Most recently, Zain, Ooredoo, and TASC Towers agreed to consolidate their tower assets, forming the largest tower company within in the Middle East and North Africa region.[7] Companies like Cellnex have also acknowledged a shift from their aggressive acquisition strategy to concentrating on delivering value from their core business and infrastructure estate.[8]

Looking ahead, until the economy levels out, maintaining profitability will remain the industry’s primary challenge as it balances growth in connectivity and efforts to streamline costs. Refocusing on the core business and customer service will become a dominant theme as cost-cutting measures take effect and price rises increase the risk of customer churn.

![]()

Return on 5G investment has yet to materialize but innovation showcases wireless capabilities

In 2023, deployment of 5G networks in Asia-Pacific markets helped offset the slower deployment in the US, where the initial building is now largely complete.[9]

In Europe, operators are now considered to be lagging, despite being amongst the first to launch 5G networks. The European Commission recently stated that additional investment of approximately €200 billion is deemed necessary to achieve comprehensive 5G coverage in all populated areas.[10] The picture is similar in the UK, where 5G availability across the four MNOs is around 10%,[11] ranking 20th for 5G coverage compared to other European Nations.[12] This has been met by industry calls and government funding initiatives to address rural 5G coverage and prevent further lag.[13]

Achieving 5G ROI remains an ongoing effort within the industry though little improvement has been observed this year. In the consumer market, mobile broadband and fixed wireless access (FWA) remain the primary use cases. Operators are also pursuing enterprise and industrial use-cases, such as private networks and network slicing, to drive new revenue growth.[14] However, enterprise demand for private networks has yet to take off at scale.

There is hope that 5G standalone networks will unlock further innovation, but few commercial platforms have yet been deployed at scale. T-Mobile US – the first operator to commercially launch a 5G standalone network in 2020 – has begun to deploy network slicing this year.[15] Open RAN development is also struggling to gain momentum, as anticipated operator rollouts have not materialized this year. Announcements from operators such as Vodafone and Virgin Media O2 indicate they are still at the early stages of their Open RAN journeys.[16]

While waiting for the materialization of 5G business cases, wireless innovation has not slowed. In the US, Verizon is utilizing mmWave spectrum to offer premium connectivity experiences in all NFL stadiums,[17] addressing the persistent challenge of reliable connectivity in crowded environments. Satellite use cases are also picking up across the US and India in attempts to address rural coverage issues and improved network reliability.[18] Satellite connectivity holds significant promise for network resilience and effective network backup modes.

Despite commercial challenges persisting in 5G, research on 6G is already underway. Notably, South Korea’s SK Telecom is investing in strategic research on 6G capabilities and its use cases.[19] The UK government has also pledged up to £100m in funding to “ensure that the UK is at the forefront of both adopting and developing 6G”.[20] As these first steps are taken, there is a clear need to avoid over-promising on 6G and be more realistic on the MNO business case for deployment.

![]()

The race to roll out fiber in Europe and the UK persists amidst economic challenges

Fiber rollouts continued at pace in Europe, with full-fiber networks in the EU39 countries surpassing 219 million homes, reaching 62.2% coverage.[21] This is up from 198 million homes the year before (an increase of 10.4%).[22]

FTTH Council Europe notes a trend of former incumbents increasing their contribution to fiber coverage, starting to close the gap between themselves and alternative operators.[23] Key 2023 M&A activity in Europe includes the completion of French company Altice’s acquisition of half of Vodafone’s German FTTP operations, a deal worth $1.2 billion.[24]

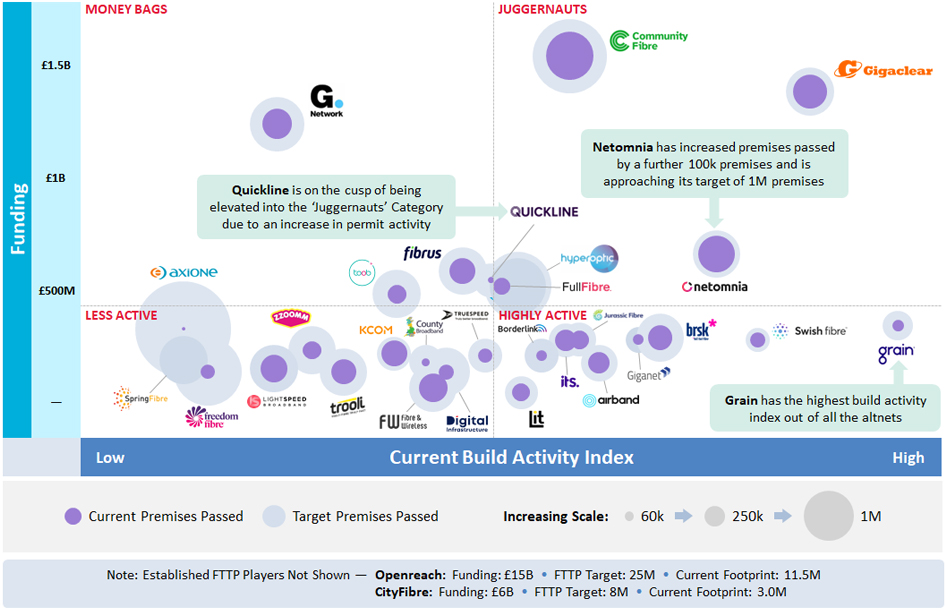

The UK fiber rollout continues to be a tight, well-funded race. Even with increased investor caution and a belief that ‘the goldrush mentality’ is over, funding for Altnets continues. Notable fund raises this year included Gigaclear securing a major new debt facility of as much as £1.5 billion and ITS Technology Group securing £100 million in debt financing.[25] 57% of UK premises have now been reached with full-fiber coverage and 78% are within reach of a gigabit-speed network.[26] While commercial investment is responsible for most of this growth, the impact of the UK government’s £5 billion Project Gigabit is apparent, with over £2 billion having been made available to broadband suppliers.[27]

Recent data shows that Openreach’s FTTP network added a record 860,000 premises to their coverage in a single quarter, now covering 11.85 million premises in the UK.[28] Despite the existence of around 100 UK Altnets, Openreach still accounts for around 80% of the UK’s broadband connections.[29] The largest competing fiber network, CityFibre, reached 3 million premises earlier this year and successfully secured multiple Project Gigabit contracts.[30] 2023 also witnessed the emergence of Nexfibre as a joint venture between InfraVia and Liberty Global/Telefónica. Nexfibre has VMO2 as an anchor customer and its goal is to construct a FTTP network of 7 million premises that do not overlap with VMO2’s existing network.[31] In September, Nexfibre in partnership with VMO2, announced the acquisition of Altnet Upp, accelerating their fiber rollout by 175,000 premises.[32]

While the UK coverage story is good, focus has now switched to customer adoption with many Altnets facing challenges amidst growing competition.[33] Although Openreach has managed to achieve a take-up rate of around one third, many Altnets fall well below this with some remaining in the low single digits, sparking concerns about sustainability.[34] In the face of high inflation and rising costs, cash preservation has become increasingly important. There have been several stories pointing to slowing build rates and job cuts in the sector.[35]

While economic uncertainty has quelled M&A activity for much of the industry, the reverse is true in the UK fiber market as investors seek scale and cost-efficiencies. In September, Fern Trading finalized the consolidation of its four full-fiber networks.[36] In a similar move in October, Basalt Infrastructure Partners LLP, an infrastructure investment firm, announced the merger of Digital Infrastructure and Full Fibre.[37] Other deals include Voneus merging SWS Broadband and Cadence Networks into its operations and acquiring Broadway Partners from administration, and Telcom Group’s acquisition of Luminet which was also finalized this year.[38] As we head into 2024, further consolidation is expected, and we may see smaller firms merge as equals to scale up rather than exit at current valuations.

Updated October 2023, Source: Operator Research, Street Works, News Articles, Cartesian

![]()

US cable broadband growth stalls as fiber and fixed wireless access gain subscribers

Over in the US, cable broadband holds around 65% of US broadband subscribers but saw limited growth this year: the top cable companies recorded only a 0.8% increase in total subscribers in the first half of the year.[39] For large cable firms, mobile is now a key source of revenue growth. Cable Mobile Virtual Network Operators (MVNOs) marked a 41.1% subscription increase year-over-year in Q2 2023.[40] This growth is attributed to investments in fixed and wireless convergence strategies, along with aggressive promotional activities. Comcast and Charter also benefit from favorable wholesale rates from Verizon based on an agreement from 2011.[41] Smaller cable companies may struggle to replicate this success.

Cable’s primacy is being challenged by fiber, with fiber gaining market share as new networks are rolled out.[42] Fiber’s market share is expected to grow from 19.5% in 2023 to 24.7% by 2028.[43] In 2022 we saw the highest annual deployment of fiber ever, and the impact of the United States’ BEAD (Broadband Equity, Access, and Deployment) Program funding will support further increases in coming years.[44] Some cable companies are rolling out their own fiber to expand their service footprints, further boosting fiber’s market share.[45]

The US fiber take-up rate is significantly higher than in the UK’s at 44.7% compared to around 20% in the UK.[46] Despite this, much of the advice at the Fiber Connect 2023 Conference centered on ensuring take-up, not just extending networks.[47] However, challenges to the growth of fiber networks exist, such as labor shortages, labor cost pressures, and inflation, leading to lowered build targets. This has caused some commentators to say that 2023’s fiber construction is likely to be consistent with 2022.[48]

Returning to BEAD, in June, the NTIA announced how the $42.5 billion funding package will be divided between states and territories, with allocations ranging from $27 million for the US Virgin Islands to over $3 billion for Texas.[49] Alaska was awarded the most on a per capita basis due to the high cost of extending fiber to hard-to-reach areas.[50] However, the fact that the BEAD allocation formula only considered unserved, not underserved, locations, and its limited consideration of deployment costs, means that there were winners and losers when it came to the allocation of BEAD funding. This has left some states with insufficient funding to achieve fiber deployment to even those locations below a reasonable ‘extremely high-cost threshold.’[51]

Although the allocation of funds was flawed, project planning continues to move forward. In December, Louisianna became the first state to gain NTIA approval of its BEAD initial plan.[52] The first funding to projects could occur in late 2024, although it will be 2025 before the money really starts to flow.[53] The prospect of new funding entering the fiber market has encouraged private equity companies to invest in fiber too, with companies that are set to receive BEAD funds looking particularly attractive to investors.[54]

Fiber is not cable’s only competition: FWA subscriber growth significantly outweighs net adds to cable companies.[55] S&P Global projects that FWA growth will stabilize over the next year as it continues to garner the majority of industry net adds, resulting in limited cable broadband subscriber growth.[56] The FWA market share is also expected to grow, increasing from 7.3% in 2023 to 15.8% by 2028.[57] Despite this, cable companies claim to not see FWA as a threat due to its inability to meet speed demands, an argument supported by the increasing rate of disconnects seen for FWA.[58] Although, interestingly, large cable firms have started launching wireless offerings.[59]

![]()

Pay TV continues to lose subscribers globally as competition between streaming platforms increases

In 2023, Pay TV providers continued to see revenue and subscriber numbers decrease, as users switch to streaming services and alternative video platforms. While live sports and cable news once kept subscribers loyal to Pay TV, these are increasingly being offered by streaming services, weakening Pay TV’s longtime hold on consumers.[60]

In the US, Q1 Pay TV subscriber losses were higher than in any previous quarter reported.[61] In contrast, streaming services continue to experience user growth. In August, streaming’s share of US TV viewing time was 8% ahead of cable TV – up from a 0.5% difference just one year earlier.[62] In Q3, UK households with at least one streaming service increased by half a million.[63]

The shift in focus away from traditional Pay TV can be seen among MSOs as they pivot towards other solutions. For example, Charter and Comcast’s joint venture, Xumo, offers free ad-supported streaming, both live and on-demand content, integration with streaming apps, and associated hardware.[64] Meanwhile, at Disney, Chief Executive Bob Iger said that some of Disney’s TV networks may no longer be ‘core’ to the company, and Disney is reviewing areas to cut costs.[65]

It should be said that challenges are not absent from the streaming market, as competition continues to intensify and cost-of-living increases bite. In November, Disney announced that it was buying Comcast’s stake in Hulu, giving Disney the ability to test a combined Disney+ Hulu streaming service.[66] Warner Bros Discovery merged its two streaming services, HBO Max, and Discovery+, into one platform, Max.[67] Further mergers are expected going forward. Mobile-based video platforms such as TikTok continue to compete for attention, taking viewing hours away from subscription services.[68]

The screenwriter and actor strikes in 2023 also caused unexpected challenges for streaming services, as numerous US productions were shut down. This impacted streaming services, particularly those with a higher proportion of scripted content, leading to lower content spending and cost of revenues for Netflix than anticipated, which are likely to rise again.[69] However, Netflix’s large share of international content gave the platform some protection from the strikes compared to competitors.

After reporting subscriber and revenue decreases in 2022, a crackdown on password sharing has also increased Netflix’s subscriber base across all regions.[70] The company’s push to monetize homes sharing a password led to Netflix adding 8.8 million net new subscribers in Q3, pushing their subscriber rate to an all-time high.[71] Following in Netflix’s footsteps, Disney’s CEO has announced that Disney+ will also be cracking down on password sharing starting in 2024.[72]

Despite improvements in Netflix subscription numbers, investor confidence is wavering. Netflix shares peaked in July, but then fell nearly 25% in the following three months.[73] While shares jumped back up after positive Q3 results and the end of the actors and writers strikes, the share price is far from its 2021 peak.[74] With its fluctuation in subscriber numbers, revenues, and share price in the past two years, Netflix is one to watch in 2024.

![]()

The impact of AI on telecommunications industry advances

Artificial Intelligence (AI) went mainstream in 2022 following the launch of ChatGPT, OpenAI’s generative AI platform. This launch dominated headlines, sparking discussions on the far-reaching impact of AI, particularly generative AI, on the global TMT industry. Recent forecasts project global generative AI in the telecommunications market to reach $5 billion by 2032, growing at a CAGR of 41.6% from 2023.[75]

For telecommunications providers, the full market impact remains uncertain, but the burgeoning number of use cases primarily centers around three pivotal areas: network management, customer experience, and business optimization. Industry leaders like SK Telecom and Deutsche Telecom have begun taking proactive steps to ensure preparedness for this transformative opportunity, recently forming the Global Telco AI alliance with other major CSPs.[76]

At the heart of industry generative AI discussions is how CSPs can harness AI for network operations and driving efficiencies. Traditional AI and generative AI are being positioned as tools to support network management processes, resource allocation, and fault resolution. This will help operators to optimize network performance, reduce downtime, and decrease network operational costs. Further down the line, AI is tipped to play a pivotal role in 6G network optimization and power efficiency.[77]

Another benefit for the industry will be to further leverage AI capabilities for customer service channels. Whilst IVR menus and chatbots have been used for years, generative AI technology holds the potential to further evolve digital customer service and reduce customer churn. It enables providers to extend support hours, swiftly resolve issues, and free up support teams to concentrate on more complex problems. A recent survey unveiled that 64% of CSP executives anticipate improvements in customer service metrics through AI deployment,[78] with companies like Lumen already piloting new Microsoft AI tools to enhance their customer service.[79] Moreover, generative AI technology can be embedded into broader CRM strategies to drive sales and brand loyalty by analyzing customer behavioral data to deploy hyper-personalized customer offers.[80]

AI also presents opportunities for workforce optimization, by streamlining operations and enabling businesses to run more efficiently while reducing headcount. Large network operators are increasingly seeking efficiency and agility through AI-driven automation, with companies like BT planning significant workforce reductions, with at least 10,000 role reductions attributed to automation and digitization.[81]

However, the full impact of generative AI remains unknown, and the regulatory landscape is likely to evolve. A recent survey revealed that 76% of digital service provider (DSPs) leaders acknowledged the power of generative AI, but that it required regulation.[82] DSPs are encouraged to begin preparation for an AI-dominated future, ensuring their services are prepared to meet increasing internal and external demand. Colt’s CEO recently hailed their acquisition of Lumen in putting them in a strong position to meet the growth in enterprise AI usage.[83] Networks must promptly assess if they have sufficient network and data infrastructure, skilled workforce, and strategic partnerships in place to meet the changing market dynamics.

Recap of 2023 Predictions: How’d we do?

1. Inflation will squeeze margins, requiring operators to develop cost-optimization strategies and curtailing investment. It is also likely to increase M&A activity in an increasingly competitive market.

YES. The continuation of inflation and rising interest rates led to capital constraints and margin pressure around the world. TMT companies have indicated cost-optimization strategies throughout 2023, such as plans for job cuts (e.g., BT, Vodafone UK, T-Mobile, Nokia, Ericsson) and executive signalling for slowing 5G investment.[84] The volume and size of M&A haven’t shown strong growth despite intensifying competition, but consolidation remains as an essential theme of the deals that did go through, in line with our prediction.

2. New streaming platforms will continue to poach exclusive rights to high-value content from major players like Netflix yet will struggle to establish a profitable customer base as a standalone product.

YES. As increasing numbers of studios release their own streaming platforms, they have pulled licensed content from big players like Netflix.[85] For instance, Paramount+, pulled nearly all Star Trek content from Netflix, making it exclusively available on the new platform. While the continuation of pulling licensed content will pose challenges to Netflix, Paramount+ has yet to make meaningful gains on the streaming giant, showing just how difficult it is to compete with Netflix.[86] NBCUniversal’s streaming platform, Peacock, launched in 2020, gained rights to stream popular comedy series New Girl,[87] but Peacock’s increasing subscriber numbers have not translated into profit, either.[88] While newer streaming services once said they would not license their content to Netflix, their need for revenue has caused a change in discourse, and Netflix is making deals with them once more. Disney CEO Bob Iger stated that Disney was in discussions with Netflix about licensing opportunities, despite strong statements to the contrary earlier this year.[89]

3. Competition for home connectivity subscribers will heat up. Fixed wireless access providers will respond to the new bundle pricing offered by traditional ISPs with their own aggressive offers.

YES. Competition for home connectivity subscribers is increasing. In the US, FWA is typically a cheaper option in comparison to cable or fiber and has been offered as a bundle with existing mobile plans, increasing its attractiveness.[90] T-Mobile and Verizon have each reported passing 17 million locations with FWA as of mid-2023.[91] As access increases, so do FWA subscriber numbers, with T-Mobile reaching over 4 million subscribers and Verizon reaching almost 2.7 million by Q3 2023.[92] In the UK, competition between fiber broadband operators has led to aggressive pricing in some areas, sacrificing short-term ARPU to drive customer acquisition.

4. Pay TV viewership will continue to plummet, falling below 30% of total TV time in the US in 2023. The trend to streaming and alternative video consumption models such as TikTok and YouTube will continue.

YES. In July, Pay TV viewership fell below 30% of total TV time in the US for the first time, as streaming continues to experience increases in viewership alongside alternative video consumption models such as TikTok.[93] The top traditional Pay TV providers in the US lost over 5.2 million subscribers in the first three quarters of 2023, bringing the total down to 56.8 million.[94]

5. Low-cost MVNOs will gain notable market footing as consumer wallets tighten, and mobile will represent the primary growth vehicle for cable operators.

YES. In the U.S, MVNOs have reported notable customer growth. Cable operators witnessed substantial customer growth through wireless MNVO customer additions, representing 49.2% of mobile net adds in Q3.[95] This surge was due to successful cross-selling to their existing fixed customer based and aggressive free-line promotions. Even with this growth, Cable MVNOs, such as Charter, have reported a decline in mobile revenue, highlighting the critical importance of customer retention strategies to steer overall business growth.[96]

6. UK Altnet performance will be increasingly judged by operational metrics such as customer acquisition instead of build rate. Those with unattractive operational models may find it difficult to secure further capital, leading to market consolidation.

YES. As they are increasingly feeling the impact of financial pressures, Altnets have begun shifting their focus from rolling out full-fiber networks to increasing customer acquisition. Increased investor caution and scrutiny has created challenges to securing funding for some Altnets. In response to economic challenges, consolidation is now underway across the UK.

7. Satellite connectivity in ordinary mobile phones is launched, but widespread availability is hampered by commercial, technical, and regulatory complexity.

YES. Satellite-based mobile connectivity has seen some remarkable developments in 2023. AST SpaceMobile secured partnerships with more than 35 MNOs worldwide and conducted the world’s first satellite-based phone call in April.[97] Lynk and Spark collaborated to install satellite-connected cell towers in New Zealand, aiming to provide ubiquitous mobile coverage across the country,[98] while Starlink revealed its plan to launch a “Starlink Direct to Cell” service that will enable text messaging in 2024 and voice and data communication in 2025.[99] Nevertheless, several obstacles persist, including the limited availability of devices with native NTN capabilities, the regulatory hurdles in different jurisdictions, and the considerable capital expenditures required for additional satellites deployments.

8. CSPs will reduce reliance on paid ads for user acquisition, accelerating investment in the deployment of first-party data solutions. Continued low efficiency of spend on ad platforms impacted by privacy-related tracking changes will encourage the shift.

MAYBE. While Google delayed third-party cookie blocking until 2024, there was a pressing need for CSPs and other companies with paid ads to diversify to alternative digital marketing tactics, including non-paid streams like organic search as well as relying more heavily on first party customer data for targeting purposes (both generally more cost efficient). While CSPs still spend heavily on paid ads, increased competition/cost (and the efficiency of ad spend decreasing), as well as anticipated privacy-related tracking changes, will likely urge CSPs to move more towards other digital marketing tactics.

9. As growth in mobile data traffic continues to drive network energy consumption, CSPs will focus more on Radio Access Network (RAN) optimization as it’s the most dominant contributor to network carbon emission and energy bills.

YES. A GSMA study of seven MNOs found that the RAN accounted for 73% of energy consumption,[100] making it a focal point for energy efficiency initiatives. Efforts are concentrated on phasing out legacy 3G networks, migration to 5G, and integrating network optimization capabilities. For instance, Verizon is utilizing network digital twins to create models that analyze energy consumption, guide decommissioning, and site optimization settings.[101] In the UK, Vodafone credits recent stable energy usage to the retirement of legacy equipment and systems.[102] Looking forward, we anticipate increased utilization of artificial intelligence CSPs to fine-tune RAN efficiency tools while maintaining high network quality.

10. Neutral host public networks will gain traction in specific scenarios, driven by compelling economics, but won’t be a significant factor in urban densification.

YES. More use cases for neutral host public networks emerged globally in 2023. Plans for using a neutral host infrastructure provider were confirmed in Ghana to deliver nationwide 4G and 5G services,[103] and in Saudi Arabia’s to provide superior 5G experience at the new Red Sea International Airport.[104] We haven’t seen significant headlines of neutral host and urban densification, even as announcements. This is partly due to the unclear consumer demand and revenue streams.

2024 Predictions: What comes next?

1. M&A activity in the UK will pick up as consolidation within the UK altnet sector begins to accelerate – a similar wave of consolidation will begin in the US, gaining momentum in 2025.

2. The pace of AI deployments will speed up, resulting in increased adoption of public cloud solutions offered by major providers. Legacy application migrations will also increase, attracted by cost efficiencies and enhanced privacy measures. As public cloud’s share-of-wallet rapidly increases, customers will turn sharp attention to cost management measures.

3. Increased AI deployment will result in notable negative public-facing incidents that will be highlighted within the media. This will intensify scrutiny and concerns over private data security and user privacy, prompting a heightened focus on protective measures.

4. Specialist neutral hosts and private network operators are poised to advance investment in small cell development, assuming a more prominent role than MNOs in addressing this opportunity.

5. As competition in the content streaming market intensifies and the need to establish profitable business models grows, we can expect additional M&A activity to take place. Moreover, a growing number of OTT providers will introduce additional ad-based tiers to boost their revenue streams.

6. Service Providers will increasingly integrate product benefits, such as enhanced data and broadband speeds, into their converged offers, adding value beyond traditional bundle package components.

7. In the US, some states will see lower than anticipated participation in the BEAD program as a result of labor rate inflation and bid requirements, as some entities choose to sit on the sidelines.

8. The large-scale migration of compute and storage processes into the public cloud will continue as attitudes evolve, viewing it as the default location for internal and external facing workloads.

9. While UK Government infrastructure spending was high in 2023, broadband state aid projects will become more challenging to deliver due to cost of capital and overbuild risk. Contracted operator business cases will be squeezed, leading them to reconsider the benefit of participating in government funded programs (e.g., Fibrus pulling out of North East of England Project Gigabit Rollout).

10. ISPs will continue phasing out Pay-TV products due to constraints posed by content and infrastructure costs, limiting the ROI potential amidst a shift in consumer preference toward on-the-go, multi-device, OTT services.

![]()

Do you agree with our predictions? What do you think 2024 will bring to the communications sector? Share your comments on our Year-End Letter with us.

![]()

Notes:

[1] gov.uk: Project Gigabit progress update September 2023

[2] US government $42.5B BEAD funding now in play, fiber and 5G are warming up – SDxCentral

[3] Vodafone to cut 11,000 jobs as new boss says firm ‘not good enough’ – BBC News, T-Mobile US cuts jobs despite industry-leading profitability – Telecoms.com, Telefonica seeks to cut 5,100 jobs in Spain by 2026, union says | Reuters

[4] Colt completes $1.8bn acquisition of Lumen EMEA – Colt Technology Services

[5] Telecom Italia approves KKR’s $20 billion grid bid in blow for Vivendi | Reuters

[6] Virgin Media O2 sells minority stake in Cornerstone to GLIL Infrastructure – Virgin Media O2

[7] Gulf telcos Zain, Ooredoo and TASC to form $2.2 bln regional tower giant | Reuters

[8] Cellnex chief resigns as tower deals bonanza draws to a close (ft.com)

[9] Ericsson struggles in Q2 thanks to weak demand from U.S. operators (fiercewireless.com)

[10] European Commission 2023 State of the Digital Decade Report

[11] United Kingdom, September 2023, Mobile Network Experience Report | Opensignal

[12] Vodafone’s Andrea Dona: The UK has fallen behind on 5G, but not lost the race | Total Telecom

[13] Lack of rural 5G poses new digital divide, Vodafone study finds | Total Telecom; New investment boosts UK’s digital connectivity – GOV.UK (www.gov.uk)

[14] TelecomTV Big Picture Report 2023

[15] T-Mobile Now Serving Up High-Performance 5G ‘Network Slicing’ (pcmag.com)

[16] Open RAN – still a work in progress | TelecomTV

[17] Verizon’s 5G Ultra Wideband keeps football fans connected in all 30 NFL Stadiums | News Release | Verizon

[18] India’s Jio, Airtel scramble to provide satellite broadband (fiercewireless.com), The ultimate Musk-have: satellite WiFi, naturally (ft.com)

[19] Press Release < News < HOME (sktelecom.com)

[20] New investment boosts UK’s digital connectivity – GOV.UK (www.gov.uk)

[21] FTTH Council Europe: European FTTH/B Market Panorama 2023

[22] FTTH Council Europe: European FTTH/B Market Panorama 2023

[23] FTTH Council Europe: European FTTH/B Market Panorama 2023

[24] Capacity: Top 7 European telecoms M&A deals of 2023

[25] FibreProvider.net: Postcard from Connected Britain 2023; Mobile Europe: UK fibre altnets plough on but lenders are more cautious; Rural UK Broadband ISP Gigaclear Secure £1.5bn Debt Facility – ISPreview UK; TelcoTitans: ITS bags fresh funding for UK fibre rollout, eyes M&A opportunities

[26] Connected Nations 2023 – UK report (ofcom.org.uk)

[27] gov.uk: Project Gigabit progress update September 2023

[28] ISP Review: BT Group Add Record 860,000 FTTP Broadband Premises to UK Coverage

[29] Grant Thornton: UK altnets face tough year in crowded broadband market

[30] City Fibre: Cityfibre’s Nationwide Full Fibre Network Rollout Passes 3m Premises

[31] Infravia: Nexfibre; Nexfibre: Liberty Global, Telefónica and InfraVia Capital Partners Form JV to Build a New Fibre Network in the UK Covering up to 7 Million Homes

[32] Nexfibre: nexfibre acquires altnet Upp to accelerate fibre rollout by 175,000 homes in partnership with Virgin Media O2

[33] ISP Review: Fern Trading Finalise Consolidation of its UK Full Fibre Networks; BDO: Plugdin: Broadband Headwinds: The altnet challenge and the likelihood of Government intervention

[34] Financial Times: BT warns over broadband customer losses as competition hots up

[35] Data Centre Dynamics: UK altnet Hyperoptic to cut 5% of workforce; ISP Review: AltNet Woes Grow as UK Full Fibre ISP Zzoomm Sees Job Losses; ISP Review: CityFibre Restructures to Keep UK FTTP Plan on Track – Cuts 400 Jobs UPDATE

[36] ISP Review: Fern Trading Finalise Consolidation of its UK Full Fibre Networks

[37] ISP Review: FullFibre Ltd and Digital Infrastructure to Merge UK FTTP Networks

[38] Telcom Group acquires London-based Luminet | Telcom; ISP Review: Voneus Merges Broadway Partners, SWS Broadband and Cadence Networks UPDATE

[39] Leichtman Research Group: Press Releases; Dell’Oro Group: 5G Fixed Wireless and the Threat to Cable’s US Dominance; Fierce Telecom: Reevaluating the cable-fiber rivalry: Much ado about nothing?

[40] CIQ Pro: Wireless Investor: Q2 2023 US mobile metrics: Smartphone upgrades are slowing down (spglobal.com)

[41] Fierce Wireless: Comcast adds 316,000 wireless lines in Q2 2023, touts MVNO contract with Verizon; Mobile World Live: Comcast MVNO makes gains

[42] Fiber Broadband Association: Fiber Broadband Deployments Accelerate in 2022 Ahead of BEAD Funding Infusion, Setting New Homes Passed Record; Fiber Broadband Association; Fierce Telecom: Reevaluating the cable-fiber rivalry: Much ado about nothing?

[43] Global Data: FWA technology’s share to grow to nearly 16% in US broadband services market in 2028, forecasts GlobalData

[44] Fiber Broadband Association: Fiber Broadband Deployments Accelerate in 2022 Ahead of BEAD Funding Infusion, Setting New Homes Passed Record

[45] Global Data: FWA technology’s share to grow to nearly 16% in US broadband services market in 2028, forecasts GlobalData

[46] Broadband Communities: Fiber Broadband Homes Passed or Homes Connected – Which Metric Matters Most?; Computer Weekly: UK lags behind in European FTTP take-up and average broadband speeds

[47] S&P: Fiber Connect 2023: ISPs discuss challenges, opportunities with BEAD KAGAN

[48] S&P: Fiber Connect 2023: ISPs discuss challenges, opportunities with BEAD KAGAN; Light Reading: The COVID hangover: US fiber providers slow down

[49] Fact Sheet: Biden-Harris Administration Announces Over $40 Billion to Connect Everyone in America to Affordable, Reliable, High-Speed Internet | The White House; NTIA: Biden-Harris Administration Announces State Allocations for $42.45 Billion High-Speed Internet Grant Program as Part of Investing in America Agenda

[50] Fierce Telecom: Fastwyre scores $70M in USDA grants to expand fiber in Alaska

[51] Cartesian: Addressing the USA Broadband Availability Gap: Expected Funding and Scenario Planning for States

[52] National Telecommunications and Information Administration: Biden-Harris Administration Approves Louisiana’s “Internet for All” Initial Proposal

[53] Congressional Research Service: Broadband Equity, Access, and Deployment (BEAD) Program

[54] Fierce Telecom: Private equity can move faster on fiber deployments than government

[55] Leichtman Research Group: Press Releases

[56] S&P Global: Credit FAQ The Evolving Landscape Facing US Cable Operators

[57] Global Data: FWA technology’s share to grow to nearly 16% in US broadband services market in 2028, forecasts GlobalData

[58] Light Reading: Cable broadband getting hammered by FWA but poised to recover; Benton Institute for Broadband and Society: Fixed wireless access ‘another form of DSL,’ Charter CEO says; Fierce Telecom: Reevaluating the cable-fiber rivalry: Much ado about nothing?

[59] S&P Global: Credit FAQ The Evolving Landscape Facing US Cable Operators; Dell’Oro Group: 5G Fixed Wireless and the Threat to Cable’s US Dominance

[60] S&P: Cable news can limit cord cutting as sports shifts online; S&P: Importance of sports grows for US pay TV households

[61] Leichtman Research: Major Pay-TV Providers Lost About 2,215,000 Subscribers in 1Q 2023

[62] Nielsen: Streaming grabs 35% of TV time in August, but overall usage dips as summer winds down; Nielsen: Sports and news boost broadcast and cable viewing in August; streaming declines as kids head back to school

[63] Kantar: UK streaming market shows signs of growth with SVoD and FAST on the rise in Q3

[64] Xumo.com; Comcast: Xumo Begins Nationwide Rollout of Its First Streaming Devices in Charter and Comcast Households

[65] Financial Times: Disney weighs options for TV networks as cord-cutting accelerates

[66] Reuters: Disney to buy remaining 33% stake in Hulu from Comcast for at least $8.6 bln; Cnet: Merged Hulu and Disney Plus Streaming App to Arrive as Beta in December

[67] USA Today: HBO Max and Discovery+ are now one ‘Max’: What to know about the new combined streaming service

[68] Business of Apps: TikTok Revenue and Usage Statistics (2023)

[69] S&P: Paid sharing rollout boosts Netflix subscriber growth in Q3 2023

[70] Business of Apps: Netflix Revenue and Usage Statistics (2023)

[71] S&P: Paid sharing rollout boosts Netflix subscriber growth in Q3 2023

[72] Forbes: Disney+ Sheds Record 11.7 Million Subscribers, Announcing Price Increase And Password Crackdown Coming

[73] City Index: Nasdaq 100 forecast: How will Netflix earnings impact NFLX stock?.

[74] CNBC: Netflix flips the streaming script again with a return to growth mode; Barrons: The Hollywood Writers Strike Is Over. What It Means for Netflix and Disney Stocks.

[75] Generative AI in Telecom Market Size SWOT Analysis 2023 To 2032

[76] CSP giants form Global Telco AI Alliance | TelecomTV

[77] The transformative effect AI is having on the telecoms sector – Telecoms.com

[78] The transformative potential of generative AI for the communications industry – Telecoms.com

[79] Lumen tests Microsoft generative AI tool to boost customer service (fiercetelecom.com)

[80] Elevating telecom customer service with AI | IBM

[81] BT to cut 55,000 jobs by 2030 as AI advances – Verdict

[82] DSP Leaders Report Telecom’s take on AI 2023

[83] Lumen EMEA acquisition gives Colt an edge, says CEO | TelecomTV

[84] LightReading: What they’re saying about 5G capex in 2023 and 2024

[85] The Guardian: Netflix faces losing licensed hit shows to streaming rivals

[86] Hollywood Reporter: Paramount Streaming Loss Widens to $511M as Paramount+ Hits 60M Subs; Deadline: ‘Star Trek: Prodigy’ Finds New Home At Netflix After Paramount+ Cancellation

[87] TBI Vision: Hulu & Peacock to share ‘New Girl’ after Netflix license expires

[88] Hollywood Reporter: NBCUniversal Quarterly Revenue Rises, But Peacock Loses $651M

[89] Hollywood Reporter: Disney Won’t “Chase Bucks” But Will License Some Content to Netflix, Bob Iger Says

[90] Hal Singer & Augustus Urschel, Econ One, ‘Competitive Effects of Fixed Wireless Access on Wireline Broadband Technologies’ (June 2023), https://api.ctia.org/wp-content/uploads/2023/06/Competitive-Effects-of-Fixed-Wireless-Access-on-Wireline-Broadband-Technologies-FINAL.pdf

[91] FCC broadband data, June 2023

[92] Light reading: T-Mobile exceeds in Q3, talks broadband strategy

[93] Nielsen: Sports gave broadcast channels a second straight month of viewing gains in September; Business of Apps: TikTok Statistics

[94] Leichtman Research Group: Press Releases

[95] Cable snared nearly half of US mobile line adds in Q3 – analyst (lightreading.com)

[96] Convergence proves a winning proposition for US cable MVNOs – Verdict

[97] https://www.telecomtv.com/content/access-evolution/ast-spacemobile-boasts-satellite-to-smartphone-breakthrough-47333/

[98] https://www.telecomtv.com/content/access-evolution/spark-plans-a-network-of-satellite-connected-cell-towers-49079/

[99] https://www.ispreview.co.uk/index.php/2023/10/starlink-updates-on-plan-for-4g-space-mobile-direct-to-cell-service.html

[100] GSMA Intelligence (Going green: benchmarking the energy efficiency of mobile (gsmaintelligence.com)

[101] How Verizon is using digital twins to reduce energy costs (tmforum.org)

[102] Vodafone UK shares its recipe for energy efficiency | TelecomTV

[103] Ministry of Communications and Digitalisation, Ghana: Ghana to establish a neutral shared infrastructure company to deliver nationwide 4G/5G services

[104] Arab News: ACES and Red Sea Global Deploy Indoor 5G Coverage at Red Sea International Airport