5G New Radio – Emerging Spectrum Bands

By Shahed Mazumder

The 5G spectrum requirements are primarily driven by the expected increase in traffic capacity demands and the support for new use cases that will be enabled by the 5G ecosystem. The 5G technical requirements (e.g. peak data rate >10Gbps, cell edge data rate of 100Mbps and 1msec latency end-to-end [i]) could potentially be met in a variety of carrier frequencies. Peak data rates are empirically linked to available spectrum per the Shannon-Hartley theorem, which states that capacity is a function of bandwidth (therefore, spectrum) and channel noise [ii]. High frequency spectrum, specifically in the millimeter-wave range, thus becomes an excellent candidate for 5G use cases since it comes with very high bandwidth.

Millimeter-wave: What is it?

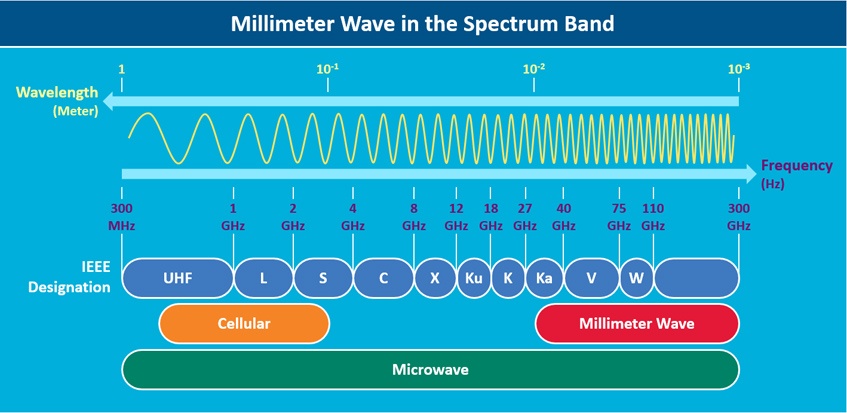

Millimeter-wave spectrum, also referred to as mmWave, is the band of spectrum between frequencies of 30 GHz and 300 GHz. This band is called millimeter-wave because the wavelength ranges from 1 millimeter to 10 millimeters. Microwave frequencies above 6 GHz are also commonly categorized as millimeter-wave to draw a distinction between these high frequency spectrum bands and the conventional cellular bands under 3 GHz of frequency.

Source: Millimeter-wave Mobile Broadband: Unleashing 3-300 GHz Spectrum, 2011

Millimeter-wave: The 5G enabler?

Millimeter-wave is being actively pursued by academia, standard organizations, regulatory commissions, and industry insiders as a key enabler of 5G by allocating more bandwidth to deliver faster, higher-quality video, and multimedia content and services. Today, millimeter-wave frequencies are primarily used for indoor applications such as streaming high-resolution video.

Historically, cellular networks have avoided these high frequencies due to high propagation loss resulting in shorter travel distance, poor building penetration, as well as absorption from rain drops [iii]. But recent technological advancements have made millimeter-wave a commercially viable prospect.

Short transmission paths and high propagation losses allow for spectrum reuse by limiting the amount of interference between adjacent cells. Additionally, where longer paths are desired, the extremely short wavelengths of millimeter-wave signals make it feasible for very small antennas to concentrate signals into highly focused beams with enough gain to overcome propagation losses.

The short wavelengths of millimeter-wave signals also make it possible to build multi-element, dynamic beamforming antennas that will be small enough to fit into handsets [iv]. Advances in silicon manufacturing have reduced the cost of millimeter-wave equipment dramatically to a point where it is feasible for consumer electronics.

With ongoing research to address the remaining technical issues, millimeter-wave adoption for 5G seems to be a given.

Which spectrum bands are winning support for 5G?

The International Telecommunication Union (ITU) and 3GPP have aligned on a plan for two phases of research for 5G standards. Phase-1 defines a period of research for frequencies under 40 GHz to address the more urgent subset of commercial needs by September 2018. Phase-2, slated to begin in 2018 and end in December 2019, addresses the KPIs outlined by IMT-2020 and focuses on frequencies up to 100 GHz.

To globally align the standardization of millimeter-wave frequencies, ITU released a list of proposed, globally-viable frequencies between 24 GHz and 86 GHz after the World Radiocommunications Conference in November 2015 (WRC-15) [v]:

- 24.25-27.5 GHz

- 31.8-33.4 GHz

- 37-40.5 GHz

- 40.5-42.5 GHz

- 45.5-50.2 GHz

- 50.4-52.6 GHz

- 66-76 GHz

- 81-86 GHz

At around the same time (October, 2015), the Federal Communications Commission (FCC) in the US issued a Notice of Proposed Rule Making (NPRM) that recommended new flexible service rules among the 28 GHz, 37 GHz, 39 GHz, and 64-71 GHz bands [vi] – setting up the favorites in the US side to win the race for leading 5G new radio frequency.

Spectrum bands: The service providers’ choice

In the US, Verizon and AT&T are aiming to roll out an early version of 5G, largely for field trials, within this year. Korea is working to conduct 5G trials keeping the Winter Olympics of 2018 in mind, and NTT DoCoMo in Japan wants to demonstrate 5G technologies at the Tokyo Olympics in 2020. Through these leading service providers, the frequencies that are enjoying early momentum as 5G new radio are 28 GHz, 39 GHz, and 73 GHz [vii].

The Leading Contender: 28 GHz

The 28 GHz band has gathered widespread support from the leading service providers and vendors in Korea, Japan, and the US:

- In February 2015, Samsung performed its own channel measurements and showed that 28 GHz is a viable frequency for cellular communications with propagation distances of over 200 meters.

- In Japan, NTT DoCoMo partnered with Nokia, Samsung, Ericsson, Huawei, and Fujitsu to conduct field trials at 28 GHz, along with a few other frequencies. In March 2017, Softbank and Ericsson announced a 28 GHz trial in Tokyo that will involve indoor and outdoor environments covering both device mobility and stationary tests [viii].

- In the US, Verizon’s acquisition of XO Communications has given them access to 28 GHz spectrum that the carrier is leveraging to support their field trials of 5G fixed wireless. AT&T has said that given the 3GPP’s decision to accelerate elements of the 5G new radio timeline, it’s possible that standards-based mobile 5G services could be starting as early as late 2018 – a year ahead of the previously anticipated timeframe.

The Close Follower: 39 GHz

Both Verizon and AT&T in the US have also shown considerable interest in 39 GHz. Though focusing on 28 GHz for its initial field trials, Verizon also plans to test at 39 GHz, again the spectrum access gained through the acquisition of XO Communications which owns substantial licenses in that spectrum band as well.

One of the challenges with 39 GHz (vs. 28 GHz/73 GHz) is that this spectrum band is more crowded with a variety of use cases [ix]. In its latest move, earlier this month (April 2017), AT&T announced that it is acquiring Straight Path Communications in an all-stock deal valued at $1.6B to bulk up the carrier’s portfolio of millimeter-wave spectrum. Straight Path holds an average of 620 MHz in the top 30 US markets and covers the entire nation with its 39 GHz spectrum (along with its holding in 28 GHz) [x]. This acquisition follows another acquisition that AT&T made earlier this year (February, 2017) – FiberTower, which went bankrupt but owns airwaves in the 39 GHz (along with 24 GHz) band covering 30B MHz POPs [xi].

The Real Deal? 73 GHz

The channel measurements taken by NYU at 73 GHz were leveraged by Nokia to begin research at this frequency band. Huawei also demonstrated a 73 GHz prototype with Deutsche Telecom at Mobile World Congress (MWC) 2016. One key advantage of 73 GHz that sets it apart from 28 GHz and 39 GHz is the available contiguous bandwidth. With 2 GHz of contiguous bandwidth for mobile communications, 73 GHz is the widest of the proposed frequency spectra. By comparison, 28 GHz offers 850 MHz of bandwidth and the two 39 GHz bands offer 1.6 GHz and 1.4 GHz bandwidth in the US. As per the Shannon-Hartley theorem, more bandwidth equates to more data throughput, and that gives 73 GHz a big advantage over the other contenders [xii].

Doubt over Millimeter-Wave

There are skeptics about the widespread usage of millimeter-wave in 5G. To some, the attraction of very high-frequency millimeter-wave spectrum is over-hyped. The argument is that the signals don’t travel very far and don’t go through many objects, therefore requiring a lot of base stations to cover a given area, for which site rental costs and backhaul costs become prohibitively expensive. They believe that the usage of millimeter-wave frequencies will be limited to hotspots, such as shopping, tourist, or other public areas [xiii]. Vodafone Group’s CTO also expressed a similar reservation at MWC 2017, arguing that the sub-6GHz spectrum is likely to represent the “sweet-spot” for 5G [xiv].

What’s next?

There are still a lot of uncertainties around the final choice of the 5G spectrum and relevant standards. However, it’s increasingly clear that millimeter-wave bands will be a key enabler for 5G.

The large amount of contiguous bandwidth available above 24 GHz is needed to meet data throughput requirements, and researches and lab trials have already shown that millimeter-wave can deliver multi-gigabit per second data rates. The biggest unanswered question is which millimeter-wave band should be used for mobile communications.

The ITU may play a role in setting one frequency for mobile use with 5G. It will be hugely beneficial to handset makers and even to network infrastructure vendors if only one set of silicone instead of the multiple chips needed in today’s phones and network equipment emerges for 5G global coverage. Finding a single band that can be agreed upon globally is an admirable goal to strive for but ultimately might not be achieved. To meet aggressive timelines, service providers in different regions are ignoring the ITU’s recommendations and using the spectrum most readily available even if it doesn’t scale globally. Verizon’s deployment of pre-standard 5G fixed wireless through the spectrum assets they gained through the XO Communications acquisition is but one example of a service provider acting independently.

The competitive environment is breeding new innovative approaches such as the one demonstrated by PHAZR – the Texas-based company is using millimeter-wave in the downlink and sub-6 GHz spectrum in the uplink, which eliminates the need for a power-hungry millimeter-wave transmitter in 5G devices, thus reducing cost and power consumption [xv].

Despite the challenges and reservations, the support and momentum for millimeter-wave to enable 5G use cases are strong. Stakeholders from all fronts – service providers, chipset and device manufacturers, and network infrastructure vendors – are combining forces to overcome challenges associated with high-frequency millimeter-wave. So, as far as deployments are concerned, the debut of millimeter-wave is only a matter of when. The question of what frequency would emerge as the dominant choice still remains. Which would you pick? <>

![]()

Sources:

[ii] Taub, H., and Schilling, D. L. Principles of Communication Systems. McGraw-Hill. 1986.

[iii] Tracy, Phillip. “What is mm wave and how does it fit into 5G?” RCR Wireless. Aug 2016.

[iv] Tracy, Phillip. “What is mm wave and how does it fit into 5G?” RCR Wireless. Aug 2016.

[vii] “mmWave: Battle of the Bands” National Instruments White Paper. Apr 2017.

[viii] “Ericsson, SoftBank 5G trail in Tokyo to include mobility at 28 GHz” Fierce Wireless. Mar 2017.

[ix] “mmWave: Battle of the Bands” National Instruments White Paper. Apr 2017.

[x] “AT&T to acquire Straight Path in $1.6B deal for spectrum” Fierce Wireless. Apr 2017.

[xi] “AT&T quietly acquires FiberTower for 24, 39 GHz spectrum” Fierce Wireless. Apr 2017.

[xii] “mmWave: Battle of the Bands” National Instruments White Paper. Apr 2017.

[xiii] “5G Spectrum to Cost Less Than 4G, Says Expert” Light Reading. Mar 2017.

[xiv] “Vodafone CTO ‘Worried’ About 5G mmWave Hype” Light Reading. February 2017.

[xv] “PHAZR aims to deliver commercial-ready 5G products in H2 of 2017” Fierce Wireless. Mar 2017.