In 2022, we saw the impact of the pandemic start to unwind but there was no let-up in demand for reliable, high-speed communications. Investment in network expansions and upgrades has continued at pace, buoyed by government programs for harder-to-reach areas. Meanwhile, telcos and cable networks faced renewed competition from FWA, and streaming continues to put pressure on traditional pay-TV.

Looking ahead, broader economic concerns are driving communication service providers (CSPs) to re-evaluate their plans, focusing more on customer propositions and faster network transformation in pursuit of cost savings, especially in energy use. We expect to see providers intensify their activities in these areas to weather the storm and emerge fitter on the other side.

2022: The Year That Was

Economic pressures begin to bite, driving a need for infrastructure transformation

During 2022, the world has seen the cost of goods and services soar, sparking a cost-of-living crisis impacting customers and industries everywhere. The TMT industry has not been left unscathed – increased energy costs, rising inflation, and subsequent changing consumer behavior have put company revenues under pressure. This triggered a wave of cost-reduction initiatives across the sector targeting job cuts, product price rises, and greater ‘digitalization’.

Global providers, especially those with a heavy European presence, have cited rising energy costs as an economic pain point during recent financial updates. For example, Vodafone is facing an additional €300M in energy costs this year alone[1]. Although large operators have adopted energy-hedging strategies, those benefits will disappear over time.

Labor costs are also rising as employees demand support with the rising cost of living. BT agreed to a pay rise (up to 16%) for 85% of its workforce, following its first staff strike in 35 years.[2] The eight-day strike impacted over 40,000 customer connections.[3] AT&T noted pressures on wages driven by inflationary challenges in the US in their recent update.[4]

Household finances are also suffering as families struggle to pay their bills. In the UK, Ofcom found that 1 in 7 UK households have cut back on spending to afford their communications services, with a worrying 9% canceling their service.[5] The OTT market is also feeling the pressure as consumers are faced with the decision as to what services are now ‘necessities’ versus ‘nice-to-haves’. In news that shocked the industry, Netflix, for the first time in 10 years, reported a decline of 200,000 subscriptions in Q1.

Inflation and labor cost increases have sparked a wave of cost-reduction initiatives across the industry. Cost-cutting plans have been announced by many including Verizon, BT, Vodafone, Starry, and Disney+. Other providers like Comcast and Cox Communications are expected to follow suit.[6]

Job cuts and price increases are the predominant targets as providers look to pass cost increases on to the customer. AT&T has announced price rises on wireless plans,[7] and BT contracts are set to increase by around 14% next year.[8] Netflix and Disney+ are also increasing their monthly subscription costs and have launched cheaper, ad-based plans to drive additional revenue.[9]

While cost-cutting and price rises are paramount to maintaining a bottom line, network transformation and product development can help reduce OPEX and maintain a longer-term competitive position. This effort aims to eradicate the culprits of energy waste (namely legacy infrastructure) and implement upgrades that leverage more energy-efficient technologies. BT has already stated it can save around £500M by 2030 by switching off its legacy fixed networks.[10] EE is deploying Ericsson’s new energy-efficient 5G radio, reducing costs and enabling them to accelerate their 5G roll-out.[11] And CityFibre’s 2023 upgrade to XGS-PON is expected to deliver network cost savings and minimize power use across the network.[12] All of these examples are intended to provide a better customer experience, more sustainable networks, and ultimately reduced energy usage and OPEX.

![]()

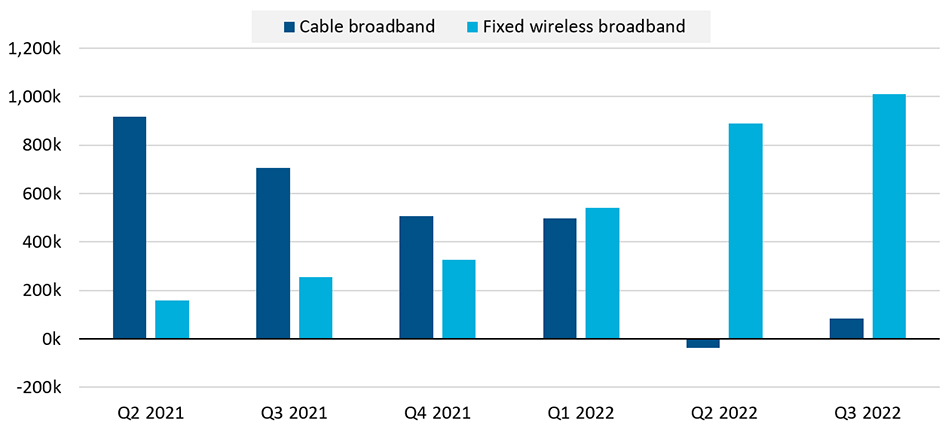

In the US, broadband cable slows, FWA takes market share but wireless offers customer growth

Cable broadband growth stalled in 2022, with Comcast and Charter seeing modest ~2% YoY growth in broadband subscribers from 2021 Q2 to 2022 Q2 (compared with 7% and 5% respectively, in the prior year).[13] A sharp increase in FWA offerings from mobile providers has had an impact.

US Broadband Net Adds

Source: Kagan media research US broadband subscriber update

FWA subscriptions more than doubled to 5M, representing about 4% of broadband connections. Further ramping up the pressure on cable, T-Mobile is exploring a $4B JV to provide fiber access in areas more suited to fixed connections.

Cable providers reluctantly accept that fixed wireless is taking market share. When reporting flat broadband growth in Q2, Comcast cited fixed wireless cannibalizing their broadband base.[14] Charter CEO Tom Rutledge attributed the slow-down partly to “lower market activity levels, particularly moves and household formations” but also noted fixed wireless as a factor impacting Q2 results.[15]

Meanwhile, Comcast and Charter found traction with US mobile subscribers through Verizon-backed MVNOs.[16] Comcast grew wireless customers by 968,000 by Q3[17] to a total of 5M in October. Wireless revenue at Comcast is 4.9% of total cable revenue and is growing at a 30% annual rate. Charter grew at a similar rate with 1.1M new mobile additions by Q3 for a total mobile base of 4.7M subscribers. [18]

In European markets, we continued to see the considerable presence of fixed-mobile convergence offerings. After UK-based Virgin Media and O2 merged in June 2021, the operator published that “more than 40% of Virgin Media O2’s broadband customers [are] also taking a mobile contract”.[19] VMO2 showed consistent customer growth in mobile connection, increasing from 41.6M at the end of 2021 to 44.2M in 2022.[20] Other operators, such as Vodafone, highlight converged products throughout the customer buy-flow as a marketing tactic.[21]

![]()

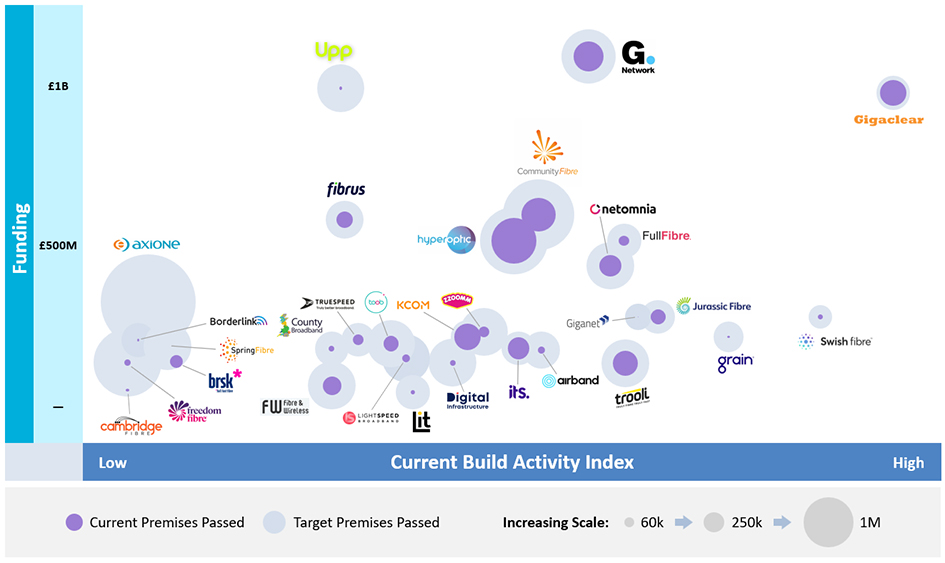

Europe’s fiber rollout and investment continue with intensifying competition moving the focus onto customer take-up

Driven by continued capital inflows, pandemic recovery, and the incentive of first-mover advantage, fiber rollout plans and build rates have maintained steady growth in 2022. In Europe, full-fiber networks now pass 128M homes, up 10.3% yearly, with 69M subscribers representing a take-up rate of over 50%.[22]

In the UK, build rate has accelerated more quickly, supported by more than £30B of investment commitment. Significant additional investments in CityFibre (£4.9B), VMO2 (£4.5B), and continued announcement of AltNet investments have seen UK full-fiber coverage reach 12.4M homes – over 40% of those in the UK, up from 9.6M since the beginning of the year.[23] If you include high-speed cable, 70% of UK premises can now access gigabit-capable broadband, meaning the industry is on track to achieve the target of 85% gigabit coverage by 2025.

UK AltNet build landscape

Source: Operator Research, Street Works, Cartesian

To help with the remaining 15%, the UK government’s Project Gigabit program subsidizes building to less commercially viable premises. The first sixteen procurement exercises either completed or in progress will provide £780M to support fiber rollout to 545,000 less commercially viable premises.[24]

While money flows into fiber investment, the threats of overbuild and rising interest rates imply that continued funding will be subject to greater financial scrutiny. For example, in the UK, AltNets’ average customer take-up rate for fiber services is forecasted to be only 12% by the end of 2022, while some fiber business models require a 30% to 40% uptake rate to make a profit.[25] Successful providers must drive take-up to justify their investment plans, or future capital may dry up.

Cartesian analysis suggests that if the FTTH plans from all UK CSPs and AltNets were realized, they would pass all UK households 2.8 times over. We closely track over thirty AltNets as they roll out fiber, measuring their pace and looking out for signs of overbuild. As competition bites, we expect some firms will struggle, raising the prospect of consolidation.

![]()

Streaming takes the top spot in US pay-TV viewership but faces pressures to continue growth

This year, streaming claimed the largest share of US TV viewing time for the first time – 35.0% compared to pay-TV’s 34.5%.[26] The moment marks a pivotal achievement in streaming’s steady rise, while pay-TV is experiencing accelerating subscriber churn, struggling to attract Gen Z, and losing bedrock content (specifically live sports and news) to streaming.

While streaming takes the top spot in TV, other content platforms such as mobile-first TikTok have poached consumer viewing time, further breaking open the content delivery business and threatening streaming’s long-term potential.

The existential threat to the traditional pay-TV business model is the generational shift away from pay-TV. In 2022, 47% of US pay-TV customers were above the age of 57, while the share of 18- to 41-year-old subscribers was only 24% (compared to streaming’s 56%).[27] This generation of cord-nevers is adding to the already rapid decline of the pay-TV base by cord-cutters.[28]

Established TV companies are responding by embracing streaming as a lifeboat. Sky has bundled Netflix and Paramount+ into standard TV packages in the UK to increase their overall value while launching the multichannel streaming service Sky Stream to slow pay-TV churn. Comcast and Charter announced a unique joint venture earlier this year in the US that will launch a streaming platform under the brand Xumo.[29] Whether TV companies can sufficiently stop churn or supplant the lost revenue with these streaming products remains to be seen.

Streaming services are also undergoing change with the increase in direct-to-consumer services for high-value content. In 2022, two US regional sports mainstays, Bally Sports and the New England Sports Network (NESN), each launched their own streaming services. The NFL is also re-branding and updating its mobile streaming service as NFL+, now including live in-market games. These new entrants continue the trend of Disney+ and HBO in taking away the bedrock content from traditional platforms like pay-TV.[30]

In the face of a fragmenting market and customers’ concerns about bills, major streaming services struggled to maintain growth. In April, Netflix reported its first net loss of 200,000 subscribers in Q1[31] though later rebounding in Q3, to add 2.3M subscribers[32]. Flat (or declining) subscriber growth is uncharted territory for the industry, putting pressure on the market’s already intense competition for consumer attention and dollars. In response, Netflix launched an ad-supported tier with lower pricing, following the trend of Discovery+, HBO Max, and Hulu. Discovery+ and HBO Max are expected to undergo changes of their own after Warner Media merged with Discovery in April to create Warner Bros Discovery. Next year, the two platforms will combine to increase their total value proposition to reduce subscriber churn.

Streaming’s most significant competition on a go-forward basis won’t be pay-TV but mobile-first entertainment platforms like TikTok (and its lookalikes Instagram Reels and YouTube Shorts). TikTok is the most popular and has grown rapidly since its introduction to the global market in 2020. It counted 27% of US households and 35% of UK adults as users in 2022. The trend is especially striking in today’s youth, with US and UK kids and teens spending 99 to 102 minutes daily on the platform.[33] As these consumers mature, expect their viewing patterns to shape the future of the video business just as millennials have propelled streaming to the forefront of the TV industry.

![]()

Global 5G rollout continues, but still little sign of advanced use cases

5G rollout continued at pace throughout 2022, with coverage and performance varying by market. South Korea remains ahead of the curve with the highest number of 5G base stations per capita and startling download speeds averaging above 400Mbps[34]. China stands close behind with more than 1.8M in total 5G active sites, five times the number of those available in Europe and the US.[35]

5G deployment sped up in Europe as well – more than 70% of the population now has access to 5G services. Italy, Denmark, and Switzerland lead with nearly complete population coverage, with the UK standing behind at around 67%[36]. In the US, 5G availability grew to 80% and 65%[37] in urban and rural areas, respectively, driven by a relentless competitive race among incumbents.

But 5G deployment isn’t cheap. Operators such as AT&T, Deutsche Telecom, and Vodafone looked to TowerCo asset sales and joint ventures to fund future investments.

Regarding 5G spectrum, mobile operators in Western countries kept prioritizing sub-6GHz frequencies in their roll-out plans thanks to its good mixture of capacity and coverage. In the US, Verizon’s focus switched from mmWave to sub-6GHz for the same reasons, while T-Mobile paid $3.5B to secure ongoing access to 600MHz low-band licenses as part of their ‘layer cake’ multi-band spectrum strategy[38]. In contrast, MNOs around the world remained cautious about mmWave. Some early adopters in the US and Japan are already undergoing commercialization, but that remains the exception rather than the norm – as of today, high-band spectrum launches account for just 7% of the total.[39]

In the consumer market, 5G global uptake continues to rise, driven by broader 5G coverage, increased availability of 5G-capable handsets, and continued growth of data traffic, primarily for video streaming. 5G subscriptions are projected to exceed one billion by the end of 2022.[40]

Operators’ strategies for monetizing 5G differ significantly across countries. In most mature, highly competitive markets (e.g., Spain, UK), MNOs have been focusing on upselling tactics by offering 5G almost exclusively in premium bundles. In less competitive markets (such as Finland), 5G offerings yield marginally higher ARPUs than 4G LTE.[41]

5G-based FWA is gathering momentum as well – MNOs see it not only as a cost-effective way to extend last-mile connectivity in remote areas or where they have excess capacity, but also as an opportunity to boost revenues by upselling their existing mobile customers. In the US, T-Mobile is already taking advantage of this trend and is projected to finish 2022 with a 67% 5G market share above Verizon at 29%.

Despite the hype, 5G is yet to supersede LTE in the private cellular networking space – as of June this year, just one in four deployments used 5G technology[42] and the overall volume of commercial deployments is low. The biggest news in this space is the launch of private 5G and edge solutions from AWS, Google, and Microsoft, enabled by CBRS spectrum in the US. These players represent a new dynamic in the cellular network space, and their success will be watched closely by those currently in the industry.

Recap of 2022 Predictions: How’d we do?

1. European 5G rollouts will accelerate. Private network activity will too in those with reserved spectrum, but will be a small part of the whole.

YES. 5G population coverage in Europe exceeded 70%, even if customer penetration lags the US, South Korea, and China. Countries such as the US, Germany, UK, and Japan, with spectrum allocations for private use, lead the pack in terms of private networks. However, the global deployment of such networks is estimated at only 1,000, with over half being 4G based.

2. Gigabit broadband gains traction, take-up increases as they become competitively priced.

YES. In the UK, gigabit broadband availability has increased to two-thirds of homes, up from just under half a year earlier. This has helped the UK achieve the second-highest growth in FTTH take-up in Europe this year (behind Belgium) with BT reporting a 25% take-up rate and a ‘record number of orders’ in the last quarter.

3. More MNOs will launch 5G substitutes for fixed broadband.

YES. 2022 saw the launch of more 5G FWA deployments by global mobile operators as it becomes a key 5G use-case. Kagan research tells us that 29% of global operators have an FWA product in the market, including India’s Reliance Jio, Vodafone Spain, and Orange in Botswana. FWA has been a major disruptor in the US, accounting for 78% of all broadband net adds in the last year.

4. ESG considerations increase and focus on total emissions rather than unit (e.g. CO2 per GB).

YES. Many large CSPs have issued far-reaching ESG strategies and consistently report KPIs for overall emissions annually. Energy price increases have helped to focus the mind on this topic and the whole industry will need to do even more in the years to come.

5. Many new FTTP entrants will struggle to meet their roll-out and customer take-up targets.

YES. AltNets in the UK have continued to build, but meeting rollout targets has been challenging. Openreach’s take-up rate of 27% is lower than they would like, while AltNet take-up is forecast to reach 12%. AltNets face further pressure from BT’s upcoming Equinox 2 wholesale price cuts.

6. TV will increasingly be delivered over IP through a mix of user experiences as the new normal.

YES. Streaming took the top spot in the US TV market, beating out traditional pay-TV (cable and satellite) for the first time. In the UK, broadcast video-on demand (BVoD) was the biggest growth area recorded by Ofcom, and even the BBC is talking about ‘switching off broadcast’ by 2030[43] in favor of IP delivery.

7. CSPs will grab headlines with the announcement of municipal partnerships to develop “smart cities.”

NO. We haven’t seen significant headlines of CSPs and smart cities, even as announcements. However, we have seen increased focus on specific use cases or data-led initiatives to centralize and share critical information about a city. There has also been increased focus on sustainable cities. While connectivity plays a part in all these, it’s a supporting actor rather than the headline act.

8. CSPs will face continued delays in retiring legacy platforms, and costs from the incremental complexity will add up.

YES. CSPs continue to grapple with accumulated legacy debt. AT&T is accelerating plans to decommission legacy copper networks, aiming to reduce its copper footprint by 50% in 2025. The company has seen a 16% reduction in copper-related trouble tickets, just scratching the surface of what they hope is a $6B cost opportunity.[44]

Risks and hurdles remain for CSPs to sunset aging infrastructure and the customer equipment it supports. Regulations mandating legacy compatibility, “carrier of last resort” requirements, and other restrictions limit the ambitions of full migration.[45] Further, CSPs wary of customer disruption are stepping lightly into broad customer migration plans, well-aware that the most deeply rooted customers are often the same ones serviced by legacy infrastructure and equipment.

9. Net neutrality will be reinstated in the US, rolling back the FCC’s repeal of the Open Internet Order in 2015.

MAYBE. While the topic of net neutrality has been re-introduced to US legislation, the bill still needs to pass the Senate and House.[46] FCC Chair Jessica Rosenworcel expressed support for Net Neutrality and Broadband Justice Act[47], suggesting that the reinstatement of net neutrality is still on the horizon.

10. Streaming services that have enjoyed explosive growth since early 2020 will see subscriber adds stall.

YES. In Q1, Netflix announced a decline in subscriptions for the first time in 10 years, leading to the introduction of ad-supported tiers in response. Subscriptions recovered modestly in Q3.

2023 Predictions: What comes next?

1. Inflation will squeeze margins, requiring operators to develop cost-optimization strategies and curtailing investment. It is also likely to increase M&A activity in an increasingly competitive market.

2. New streaming platforms will continue to poach exclusive rights to high-value content from major players like Netflix yet will struggle to establish a profitable customer base as a standalone product.

3. Competition for home connectivity subscribers will heat up. Fixed wireless access providers will respond to the new bundle pricing offered by traditional ISPs with their own aggressive offers.

4. Pay TV viewership will continue to plummet, falling below 30% of total TV time in the US next year. The trend to streaming and alternative video consumption models such as TikTok and YouTube will continue.

5. Low-cost MVNOs will gain notable market footing as consumer wallets tighten, and mobile will represent the primary growth vehicle for cable operators.

6. In the UK, AltNet space company performance will be increasingly judged by operational metrics such as customer acquisition instead of build rate. Those with unattractive operational models may find it difficult to secure further capital, leading to market consolidation.

7. Satellite connectivity in ordinary mobile phones is launched, but widespread availability is hampered by commercial, technical, and regulatory complexity.

8. CSPs will reduce reliance on paid ads for user acquisition, accelerating investment in the deployment of first-party data solutions. Continued low efficiency of spend on ad platforms impacted by privacy-related tracking changes will encourage the shift.

9. As growth in mobile data traffic continues to drive network energy consumption, CSPs will focus more on Radio Access Network (RAN) optimization as it’s the most dominant contributor to network carbon emission and energy bills.

10. Neutral host public networks will gain traction in specific scenarios, driven by compelling economics, but won’t be a significant factor in urban densification.

![]()

Do you agree with our predictions? What do you think 2023 will bring to the communications sector? Share your comments on our Year-End Letter with us.

![]()

Notes:

[1] Vodafone: H1 FY23 Presentation

[2] BT: BT Group makes Cost of Living Pay Rise as union recommends end to strikes

[3] TelcoTitans: BT reports 40k broadband user hit from industrial action

[4] Fierce Telecom: AT&T chief says he’s not happy about how fast wages are rising

[5] Ofcom: Affordability of communications services

[6] Fierce Wireless: Verizon lays off a ‘small number’ of workers as new cost-cutting program begins

[7] CNBC: AT&T shares fall after company says later payments, higher spending are hurting cash flow

[8] The Guardian: BT warns of more job losses as rising bills force bigger cost-cutting drive

[9] Tech Advisor: Disney+ Ad-supported Tier Release Date, Cost, News & Rumours, Netflix: Netflix Starting From $6.99 a Month

[10] TelecomTV: BT eyes savings of £500m by pulling the plug on legacy fixed networks

[11] VanillaPlus: Ericsson and EE deliver a more sustainable 5G network with European first

[12] ISPreview UK: CityFibre Upgrade UK Network to 10Gbps Full Fibre Broadband UPDATE

[13] S&P Global Kagan Estimates

[14] Channel Futures: SMBs, Fixed Wireless Bright Spots in Slumping Verizon Q2 Earnings

[15] Fierce Wireless: Charter loses 21K broadband subs in Q2

[16] Nexttv.com: T-Mobile, Verizon Fixed Wireless Subscriber Additions Could Double by 2023, Analyst Says

[17] Comcast: Comcast Reports 3rd Quarter 2022 Results

[18] Charter: Charter Announces Third Quarter 2022 Results

[19] Virgin Media O2: Virgin Media O2 bolsters future network with fibre upgrade plan

[20] Virgin Media O2: Q3 2022 financial results

[21] Vodafone: https://www.vodafone.de/privat/kombi-angebote.html

[22] FTTP Council Europe: FTTH Forecast for EUROPE

[23] Ofcom: Connected Nations 2022 UK Report

[24] UK Government: Project Gigabit Delivery Plan – autumn update 2022

[25] Financial Times: UK ‘altnets’ risk digging themselves into a hole

[26] Nielsen: Streaming grabs 35% of TV time in August, but overall usage dips as summer winds down

[27] S&P Global: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?id=72586891

[28] S&P Global: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?id=72831102

[29] Charter: Charter and Comcast Announce Joint Venture to Develop and Nationally Offer a Next Generation Streaming Platform

[30] S&P Global: https://www.capitaliq.spglobal.com/web/client?auth=inherit#news/article?id=72586891

[31] TechCrunch: Netflix loses 970,000 subscribers, its largest quarterly loss ever

[32] NBCNews: Netflix says it gained 2.4M subscribers in the 3rd quarter, more than doubling expectations

[33] TechCrunch: Kids and teens now spend more time watching TikTok than YouTube, new data shows

[34] Opensignal: Benchmarking the Global 5G Experience, June 2022

[35] European 5G Observatory: Quarterly Report 17, October 2022

[36] Ofcom: Connected Nations 2022 UK Report

[37] Mobile World Live: US 5G availability spreads

[38] Light Reading: The quiet brilliance of T-Mobile’s 5G spectrum strategy

[39] GSMA: 5G mmWave Summit presentation

[40] Ericsson: Mobility Report, June 2022

[41] Barclays: Assessing 5G progress – steady, not spectacular, October 2022

[42] GSA: Private-Mobile-Networks June 2022 Summary; Telecoms.com: LTE dominates in private mobile networks, BT bucks the trend

[43] ISPreview UK: Broadband Woes as BBC Plan to Switch Off Terrestrial UK TV by 2030

[44] Light Reading: AT&T notching 37% subscriber penetration rates in fiber markets

[45] Deloitte: Communications infrastructure upgrade – The need for deep fiber

[46] US Congress: H.R.8573, Net Neutrality and Broadband Justice Act of 2022

[47] The Media Institute: Jessica Rosenworcel: FCC Has Authority To Adopt Net Neutrality Rules