On the 1st January 2020, Dr. Robert Redfield, the head of the US Center for Disease Control (CDC) received a phone call[1] from his Chinese counterparts, informing him of the outbreak of a new Coronavirus strain. Dr. Redfield was on vacation with his family at the time but spent most of the next few days on the phone, trying to understand the ramifications of the news coming out of Wuhan. One phone call he did not make, however, was to Cartesian’s office, to let us know that we should really update our industry predictions for the year ahead. Realistically, had we made our predictions even in late January (when a colleague canceled a holiday to China “just to be on the safe side”), we still would not have come close to anticipating the impact that the virus would have on the year that followed.

We hope that this letter finds you, your families, friends, and colleagues well. The industry seems to have been remarkably resilient so far to the challenges of Covid-19. As we wrote the letter it was interesting to note the number of things that were not obviously impacted by Covid. The telecoms industry is providing the sturdy backbone on which large parts of the economy are continuing to function; TV is once again proving that it is the most cost-efficient medium for keeping us entertained. But no doubt there will be further economic consequences and changes to consumer habits that have not yet been realized. This letter concludes, as always, with our predictions for 2021 – they are, we suspect, our most uncertain to date.

2020: The Year That Was

![]()

Fiber and 5G rollouts continue

One thing to be said for lockdowns is that they are a great time to dig up roads. Fiber rollout plans were largely unaffected by Covid-19, with construction and maintenance staff designated as key workers in many countries. FTTH Council Europe estimated that Covid-19 would only cause a minor decrease (~1%) in number of homes passed by full fiber in EU27+UK countries by the end of 2020 compared to its previous forecasts[2], and that subscriber numbers would be boosted by ~2.5% with a subsequent acceleration of rollouts in future years expected. Overall, in 2020, France added 4.6m homes passed by FTTH/FTTB, Italy 3.8m and Germany 1.9m.

In the UK, the year started with the completion of CityFibre’s deal to acquire FibreNation from TalkTalk Group for £200 million, with CityFibre announcing plans to increase its 2025 target from 5 million to 8 million UK premises, and in May, BT announced a £12bn investment target to build full fiber to 20m premises across the UK. The end of the year, however, saw the first sign of negative Covid impacts, with the UK government slowing the schedule of its £5bn rural broadband investment fund. The UK government has also progressively watered down its commitment made in 2019 of 100% fiber rollout by 2025: firstly altered to 100% “gigabit” broadband to enable the inclusion of Virgin Media’s network upgrades and 5G, this target has now been reduced to 85% coverage.

In the US, the FCC approved a $16bn rural broadband fund in June[3] – the Phase I Auction of these funds was completed in December[4], with $9.2bn allocated to a wide range of providers requiring them to build to 5.2m currently unserved homes. Of these homes, around 20% will be covered by Charter Communications, while SpaceX (which operates the Low Earth Orbit (LEO) satellite broadband service, Starlink) was awarded ~$900m to cover ~640k homes.

5G has had an interesting year. In February, the Swiss environment agency forced Swiss cantons to place a moratorium on the use of all new 5G towers due to health concerns[5], a decision that was re-iterated in April[6]. The emergence of Covid provided an unfortunate avenue for conspiracy theorists to exploit, leading to arson attacks (often mistakenly on 3G and 4G masts) across European countries[7]. During lockdown alone, the UK saw around 90 attacks take place[8].

Service providers globally, however, are still generally bullish on 5G with 36% of operators saying the pandemic had little effect on their deployment plans, and in some cases accelerated their 5G network upgrades[9]. The rate of deployment does not appear to have slowed, with 52 commercial 5G networks launching globally between March and November, bringing the total to 122[10]. The major handset players all launched 5G phones in 2020, including Apple’s first 5G handset, the iPhone 12, Samsung’s Galaxy S20, OnePlus’s 8 Pro and Google’s Pixel 5.

5G pricing models are yet to stabilize, as operators experiment with a variety of launch propositions. In the US, AT&T launched[11] its 5G services “at no additional cost”, with the caveat that 5G is only available on its “Unlimited” wireless plans. In effect, AT&T is using 5G as a carrot to entice customers onto its data-heavy plans. This seems to be a trend, with a tariff-tracking analyst reporting that the percentage of 5G plans with a 10GB data limit fell sharply during 2020[12], standing at only 12% of all plans in November. However, some operators, such as Finland’s Telia are using speed as a differentiator – all of Telia’s 5G plans offer unlimited data but range from 300Mbit/s download speeds in the basic package to 1Gbit/s in the premium. Strategies will continue to evolve as operators deal with the challenges of each region: where 5G coverage is patchy, operators may need to wait for improvement before they can charge a premium for speed; in markets such as South Korea where 5G coverage is good, but 4G coverage is excellent, operators are looking to encourage 5G upgrades through new services, with SK Telecom recently expanding its 5G content (AR/VR) business[13].

In good news for mobile operators in the UK, Ofcom has completed its clearance of the 700MHz spectrum band, freeing up 80MHz of prime mobile spectrum, effectively the end of a project that started when analogue terrestrial TV was switched off in the UK back in 2012. In the US, C-Band clearance plans continue with the auction for the lower 280MHz of the C-Band set for December 8th, which analysts have forecast could raise up to $55bn[14] from operators keen to get their hands on spectrum in the “Goldilocks” range for 5G.

![]()

Networks prove their resilience

Q1 2020 saw sudden changes in internet usage around the globe as, one after another, countries went into lockdown. OpenVault reported that consumer broadband usage in Q1 reached the level that it had forecast for the end of 2020: a year’s growth in one quarter[15]. Several UK service providers reported their highest ever traffic loads in early November, driven by multiple factors, including the start of the UK’s second lockdown as well as the releases of the Xbox Series X, PlayStation 5 and other gaming updates[16].

Impressively though, service providers coped well with the surge in demand, with monitoring companies reporting that traffic delay, loss and jitter remained within tolerable ranges during March and June in EMEA countries[17]. In the US, ACA Connects, with the help of Cartesian, launched its Covid-19 network performance dashboard[18]. It found that despite a surge in Internet usage due to Covid, service quality indicators for ISPs remained at a high level. Upload consumption saw a rise of 36% and daily download consumption rose by 27% in March, relative to the pre-Covid average for US households.

In the meantime, service providers continue with their long-term challenge to maintain and improve their existing networks and operations. In February, Deutsche Telekom announced[19] that it had switched 99% of its customers to an all-IP service, and in May, BT announced plans to accelerate the migration from its analogue phone services (PSTN) onto a new all-IP network. Estonia, one of the world’s most advanced countries IT-wise, was due to be the first country in Europe to decommission 100% of its copper exchanges (for which PSTN switch-off is a precondition) in 2020, though has reportedly only reached 80%[20]. The rest of Europe and most of the World are some way behind, but as operators look to maintain quality of service, modernize their service offerings and reduce operating costs, increasing focus is being turned to this area.

![]()

Streamers and pirates share the spoils

TV proved itself to be a vital source of entertainment for the world during multiple lockdowns. It suffered challenges of course, most obviously in the production sector which either had to cancel, postpone or radically adapt much of its content slate.

There were two clear winners during lockdown: streaming providers and content pirates. Subscribers to streaming services continued to grow at a rapid rate, but so did usage of pirate sites and the sharing of credentials. In the UK, 17 million households had access to a SVOD service in Q3 2020, up by more than 3 million since the same period in 2019[21]. Lockdown saw visits to illegal streaming sites jump from 30-50% across European countries and the US, according to piracy tracking company Muso[22].

The pandemic has not dissuaded companies from launching new services either. In France, the three main broadcasters joined their efforts to launch a new SVOD service, Salto, with support from Cartesian. The launch of Salto was delayed from spring to autumn due to Covid but Salto is now aiming to rival Netflix in a French SVOD market that has limited consumer service sign-ups, compared to e.g. the UK[23]. The performance of Salto during its first month of operation is encouraging, with more than 100,000 reported subscribers[24]. Most recently, in December, Discovery announced[25] the upcoming global launch of its originally titled streaming service, discovery+, claiming to have the largest catalogue on launch of any streaming service to date.

It is possible that there is also a third winner: traditional Pay TV. Whilst subscriber numbers have continued to fall, there is evidence that without Covid, it could have been worse – after all, even traditional Pay TV remains an efficient way of entertaining families, on a $/hr/person basis. According to the Leichtman Research Group (LRG), Pay TV in the US saw its fewest net losses in subscribers in Q3 2020 since Q1 2018 with only 120,000 subscribers lost in total by the largest providers. In fact, certain US providers even experienced gains, with Charter reporting an impressive increase in 100,000 video subscribers in Q2 2020.

One thing we have been predicting for a while is an evolution of streaming business models, as subscription fatigue takes hold and operators need to develop a wider set of propositions in order to maximise take-up. Netflix still has not flinched when it comes to including advertising on its platform, but 2020 started to see some movements in AVOD (advertising-funded VOD). The most significant was Fox’s $440m acquisition of Tubi, a free, advertising-funded service with a larger catalogue than Netflix. AVOD uptake in the US continued to grow, now at 17% of Internet users[26]. Hulu, which offers both advertising and subscription-based packages, set the additional cost of skipping ads at $6 in its latest price increases. We wait to see whether other streaming providers may follow similar pricing strategies in the near future.

Covid also drove some unexpected business model innovation. The closure of cinemas and lack of live-sport attendance saw TVOD increase in significance, as Disney released Mulan as an (expensive) add-on to its Disney+ service (now available at no extra charge), and the English Premier League made a slate of matches available to fans as an (also expensive) PPV add-on to existing packages (also now available at no extra charge). In December, Warner Bros announced that its entire 2021 slate would be released simultaneously in cinemas and via streaming on HBO Max (its Time Warner owned sibling). However, cinemas have pushed back on this plan[27] with AMC Theaters unhappy at the move – earlier in the year, AMC had negotiated with Universal to retain a 17-day cinema release window after threatening to remove all Universal films from its cinemas.

![]()

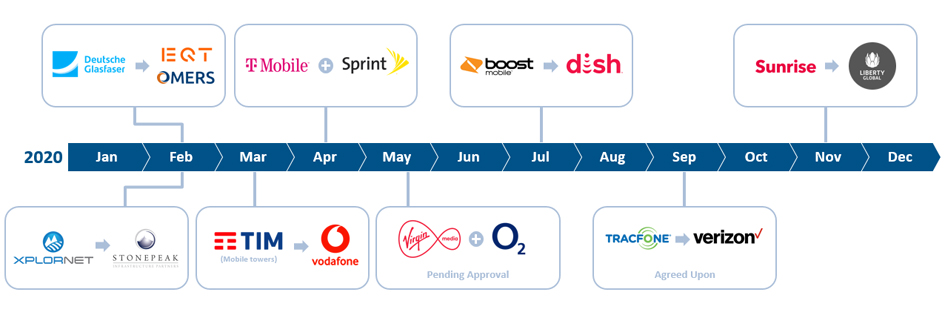

Telcos consolidate and investors look for long-term value in infrastructure

After some major acquisitions in the media sector in recent years (Comcast/Sky, Disney/Fox), 2020 has seen a reversion to good old telco consolidation and a trend towards acquisition of telco infrastructure.

Quite possibly the biggest transactional news in the UK came from the announcement of a possible merger between Virgin Media and O2 in May[28]. Pending regulatory approval, the deal will help the two companies compete more directly with BT/EE due to their complementary offerings, leaving Three UK as the only mobile operator in the market with none of its own fixed line base. We suspect that, assuming this deal goes ahead, it will not be the end of consolidation in this sector in the UK.

There were rumours throughout the year of a possible sale, or partial sale, of BT’s Openreach stake to help fund its full fiber rollout, along with further rumours of a potential private equity backed takeover attempt of BT itself.

In November, Liberty Global completed the acquisition of Sunrise Communications for 6.7bn Swiss Franc[29], representing, with UPC, the formation of a potential leading telecoms challenger in Switzerland. This could be part of a wider strategy from Liberty Global, aiming to create leading telecoms companies in all their core European markets, but comes as somewhat of a surprise given that in 2019, Liberty Global had agreed to sell UPC Schweiz to Sunrise before opposition from Sunrise investors led to the cancellation of the deal[30].

In the US, April saw the completion, 2 years after announcement, of the $26bn T-Mobile/Sprint merger, and September saw Verizon agree to buy Tracfone for more than $6bn[31] – a deal which would see the largest MVNO in the US becoming part of the largest wireless provider in the country. The transaction would give Verizon a greater position in the value and low-income wireless segments and follows Dish Network’s move in acquiring Boost Mobile earlier in the year.

On the infrastructure side, following the merger of Vodafone Italy and Telecom Italia’s mobile towers in March[32], Italy looks set to see a transition to a single, national fixed broadband infrastructure operator, through the proposed creation of FiberCop from Telecom Italia’s access network assets and the planned subsequent merger of FiberCop with state-controlled Open Fiber. The first part of this plan, the creation of FiberCop, has been approved by the EC[33]. Telecom Italia will retain a 58% stake in the new entity, with a 37.5% stake to be taken by US private equity house KKR for €1.8bn.

That proposed investment by KKR was one of many by private equity and infrastructure funds in this space. The list includes, among others: Zayo Group being taken private by Digital Colony and EQT for $14.3bn[34]; the sale of Xplornet (Canadian rural-focused service provider) to Stonepeak Infrastructure Partners for $2bn[35]; the acquisition of German fiber-optic network provider Deutsche Glasfaser by EQT Infrastructure and OMERS Infrastructure for €2.5bn[36]; the sale of just under 50% of Altice Europe’s wholesale fiber operation in Portugal to Morgan Stanley Infrastructure Partners for an initial price of €1.6bn[37].

![]()

Out of the pandemic, into the … ? (your guess is as good as ours)

2020 hasn’t just been about Covid. We’ve continued to see the changing political landscape impact on our industry, as seen in the twin barriers facing 5G of increased nationalism/protectionism (blacklisting of Huawei) and disinformation (“Covid is a hoax, it’s really 5G!”). We wait with interest to see if the presidency of Joe Biden will have an impact on either of these. Will the US return to its globalist past? Will social media companies improve (or be forced to improve) their ability to reduce the exposure of their users to disinformation?

In the meantime, TMT faces a fascinating but uncertain period – will countries face economic recessions that cause a drop in consumer spending on broadband, telephony and TV services? Or will demand for these services prove resilient? How much of the shift to home-working is permanent? Will it impact business connectivity requirements, or just increase residential needs?

Read-on to see how our crystal ball performed last year, and what it’s telling us, through slightly murky glass for next year.

![]()

2020 Prediction Review

In December 2019, we made ten predictions for this year. Here’s how we did:

1. Consumer uptake of trial market 5G fixed wireless propositions will be slow

![]() Did it happen? YES. Subscriber numbers for specific 5G FWA propositions are hard to come by, which we view as a safe indicator that take up is indeed slow. One analyst reports total global numbers of 10.3m[38], with most subscribers in US and Asia, but is forecasting rapid growth over the next 10 years. Verizon, whose 5G Home service is available in 8 US cities, expects to start seeing meaningful revenues from 5G in 2021[39]. In Q4 it launched new CPE allowing self-install for 5G Home customers and reported that it was seeing self-install times as low as 40 minutes[40]. Verizon expects the new CPE to have a significant impact on uptake in 2021 – we will keep an eye on progress.

Did it happen? YES. Subscriber numbers for specific 5G FWA propositions are hard to come by, which we view as a safe indicator that take up is indeed slow. One analyst reports total global numbers of 10.3m[38], with most subscribers in US and Asia, but is forecasting rapid growth over the next 10 years. Verizon, whose 5G Home service is available in 8 US cities, expects to start seeing meaningful revenues from 5G in 2021[39]. In Q4 it launched new CPE allowing self-install for 5G Home customers and reported that it was seeing self-install times as low as 40 minutes[40]. Verizon expects the new CPE to have a significant impact on uptake in 2021 – we will keep an eye on progress.

2. 5G use cases reliant on network slicing will begin to take shape

![]() Did it happen? ALMOST. 5G network slicing is being positioned as one of the key enablers of greater 5G monetization for network providers, if security concerns can be addressed and use cases better defined[41]. 2020 saw the launch of several standalone 5G networks, a pre-cursor for network slicing. Most, such as the Verizon network launch in the US[42], mention the ability to use network slicing, but specific use cases are still fuzzy. Network slicing is being used to support industrial use cases (such as creating a dedicated slice for low-latency asset tracking[43]), in the DCMS funded 5G-ENCODE project[44], at the National Composites Centre in Bristol, supported by Bristol University.

Did it happen? ALMOST. 5G network slicing is being positioned as one of the key enablers of greater 5G monetization for network providers, if security concerns can be addressed and use cases better defined[41]. 2020 saw the launch of several standalone 5G networks, a pre-cursor for network slicing. Most, such as the Verizon network launch in the US[42], mention the ability to use network slicing, but specific use cases are still fuzzy. Network slicing is being used to support industrial use cases (such as creating a dedicated slice for low-latency asset tracking[43]), in the DCMS funded 5G-ENCODE project[44], at the National Composites Centre in Bristol, supported by Bristol University.

3. Low-earth orbit satellite internet services will make an impact

![]() Did it happen? NOT YET. SpaceX’s Starlink looks to be the brightest spark in this market but is yet to move past the beta stage of its broadband internet service in the US. Starlink boasts around 900 satellites in orbit and its beta speed tests have been clocked at over 100 Mbps[45]. Having bid successfully for $900m of government funds for rural broadband, it plans to launch services in late 2020 or early 2021[46]. If successful, it could bring about a significant shake up to the rural broadband market but it remains to be seen how attractive a proposition it will prove in practice.

Did it happen? NOT YET. SpaceX’s Starlink looks to be the brightest spark in this market but is yet to move past the beta stage of its broadband internet service in the US. Starlink boasts around 900 satellites in orbit and its beta speed tests have been clocked at over 100 Mbps[45]. Having bid successfully for $900m of government funds for rural broadband, it plans to launch services in late 2020 or early 2021[46]. If successful, it could bring about a significant shake up to the rural broadband market but it remains to be seen how attractive a proposition it will prove in practice.

4. Traditional Pay-TV providers will continue to suffer heavy subscriber losses

![]() Did it happen? YES. Firstly, we should note that Covid slowed the rate of decrease of Pay TV subscriber numbers. In the US, Pay TV overall had fewer net losses in Q3 2020 than in any quarter since Q1 2018[47], and Charter Communications even added over 100,000 Spectrum video subscribers in the second quarter[48]. Nonetheless, subscription losses were seen elsewhere with AT&T[49] and Comcast[50] both experiencing a continued decline in their Pay TV customer base and revenues, and in the UK, Pay TV subscriptions have dropped 9% since the start of March 2020[51]. So, while it could have been worse, we’re still viewing these as heavy losses.

Did it happen? YES. Firstly, we should note that Covid slowed the rate of decrease of Pay TV subscriber numbers. In the US, Pay TV overall had fewer net losses in Q3 2020 than in any quarter since Q1 2018[47], and Charter Communications even added over 100,000 Spectrum video subscribers in the second quarter[48]. Nonetheless, subscription losses were seen elsewhere with AT&T[49] and Comcast[50] both experiencing a continued decline in their Pay TV customer base and revenues, and in the UK, Pay TV subscriptions have dropped 9% since the start of March 2020[51]. So, while it could have been worse, we’re still viewing these as heavy losses.

5. Streaming providers will increase focus on monetization

![]() Did it happen? NOT YET. Streaming services have benefitted from the surge in TV usage through the pandemic, and as such, perhaps 2020 has not been the best time to start messing with pricing models. We have seen some movements in AVOD with the acquisition of Tubi by Fox, but there haven’t been any truly significant developments yet (e.g. Netflix/Amazon introducing premium tiers or advertising). We wait to see who will blink first.

Did it happen? NOT YET. Streaming services have benefitted from the surge in TV usage through the pandemic, and as such, perhaps 2020 has not been the best time to start messing with pricing models. We have seen some movements in AVOD with the acquisition of Tubi by Fox, but there haven’t been any truly significant developments yet (e.g. Netflix/Amazon introducing premium tiers or advertising). We wait to see who will blink first.

6. Enterprises will seek out interpretable AI solutions

![]() Did it happen? YES. With increased data protection laws introduced across the world (see prediction #8), companies are being required to declare the processes under which they use personal data. As such, ‘interpretable’ solutions which provide clarity in AI processes are becoming increasingly sought after. Companies such as Google[52] and IBM[53] have previously created solutions that can be used to understand the Black-Box AI methodology. Increased investment is continued to be expected as AI processes become more sophisticated.

Did it happen? YES. With increased data protection laws introduced across the world (see prediction #8), companies are being required to declare the processes under which they use personal data. As such, ‘interpretable’ solutions which provide clarity in AI processes are becoming increasingly sought after. Companies such as Google[52] and IBM[53] have previously created solutions that can be used to understand the Black-Box AI methodology. Increased investment is continued to be expected as AI processes become more sophisticated.

7. Consumers will be increasingly wary of IoT security risks

![]() Did it happen? YES. Consumer wariness has been amplified in 2020 by increased media scrutiny on companies like Amazon for their home devices Alexa and Echo. Amazon were reported to be collecting consumer data and paying external contractors to listen to conversations[54]. Also, it was reported that hackers had been able to install and remove apps on home devices without an owner’s knowledge, facilitating potential data breaches[55]. In response, global cybersecurity investment has increased – the market is now worth $173bn[56] – and has seen deals such as Telefonica’s investment in Nozomi Networks[57], an IoT security provider.

Did it happen? YES. Consumer wariness has been amplified in 2020 by increased media scrutiny on companies like Amazon for their home devices Alexa and Echo. Amazon were reported to be collecting consumer data and paying external contractors to listen to conversations[54]. Also, it was reported that hackers had been able to install and remove apps on home devices without an owner’s knowledge, facilitating potential data breaches[55]. In response, global cybersecurity investment has increased – the market is now worth $173bn[56] – and has seen deals such as Telefonica’s investment in Nozomi Networks[57], an IoT security provider.

8. Data and privacy will be a top concern for global regulators

![]() Did it happen? YES. In the US, the Californian Consumer Privacy Act (CCPA) came into effect. Whilst only three US states have so far introduced privacy laws, if other states follow suit with their own legislation, there is concern that differences between states could result in significant compliance headaches for companies[58]. Other countries around the world such as Brazil and Thailand have introduced data protection laws based on the European GDPR model[59]. Countries such as India[60] and the UAE[61] are likely to follow with their own laws soon.

Did it happen? YES. In the US, the Californian Consumer Privacy Act (CCPA) came into effect. Whilst only three US states have so far introduced privacy laws, if other states follow suit with their own legislation, there is concern that differences between states could result in significant compliance headaches for companies[58]. Other countries around the world such as Brazil and Thailand have introduced data protection laws based on the European GDPR model[59]. Countries such as India[60] and the UAE[61] are likely to follow with their own laws soon.

9. Quantum computing will find a valuable application

![]() Did it happen? NOT YET. Since Google’s groundbreaking Quantum Supremacy announcement[62] in 2019, commentators and experts in the field have been voicing their doubts as to the actual significance of the results of the experiment[63]. The same problems that those trying to harness quantum computing for practical results faced in 2019 still exist today. Most notably, quantum computers and quantum bits themselves are extremely error prone and the slightest electrical interference can corrupt the value of a qubit. Furthermore, the mechanics of quantum theory mean that the simplest traditional methods of error-checking computer bits are not possible[64]. It looks like, despite the promise of the technology, real-life applications will take more time to emerge.

Did it happen? NOT YET. Since Google’s groundbreaking Quantum Supremacy announcement[62] in 2019, commentators and experts in the field have been voicing their doubts as to the actual significance of the results of the experiment[63]. The same problems that those trying to harness quantum computing for practical results faced in 2019 still exist today. Most notably, quantum computers and quantum bits themselves are extremely error prone and the slightest electrical interference can corrupt the value of a qubit. Furthermore, the mechanics of quantum theory mean that the simplest traditional methods of error-checking computer bits are not possible[64]. It looks like, despite the promise of the technology, real-life applications will take more time to emerge.

10. Global powers will draw clearer lines between technology ecosystems

![]() Did it happen? ALMOST. Data security concerns have seen the UK ban Huawei infrastructure from 5G (removal required by 2027)[65], and the US demand the Chinese video service TikTok sell its US assets to a US company[66]. The blacklisting of Huawei in the US, such that it can no longer work with Google, has led to Huawei developing its own Harmony operating system which it announced, in September, that it plans to launch on its handsets in 2021 and offer to other manufacturers[67]. Having thought that the mobile OS battles were long since over, it will be interesting to see what emerges – the Google Play store and other Google services are banned in China meaning there is a chance that Harmony could elbow Android out of the Chinese market and create a completely separate ecosystem. However, we should note that the effort to beat Covid-19 through vaccine development and contact tracing has been a global one. We even saw Apple and Google working together on their exposure notification API[68], in-use by over 40 countries[69]. Overall, while some lines are being drawn, it is not yet clear where they will end.

Did it happen? ALMOST. Data security concerns have seen the UK ban Huawei infrastructure from 5G (removal required by 2027)[65], and the US demand the Chinese video service TikTok sell its US assets to a US company[66]. The blacklisting of Huawei in the US, such that it can no longer work with Google, has led to Huawei developing its own Harmony operating system which it announced, in September, that it plans to launch on its handsets in 2021 and offer to other manufacturers[67]. Having thought that the mobile OS battles were long since over, it will be interesting to see what emerges – the Google Play store and other Google services are banned in China meaning there is a chance that Harmony could elbow Android out of the Chinese market and create a completely separate ecosystem. However, we should note that the effort to beat Covid-19 through vaccine development and contact tracing has been a global one. We even saw Apple and Google working together on their exposure notification API[68], in-use by over 40 countries[69]. Overall, while some lines are being drawn, it is not yet clear where they will end.

Predictions for 2021

Looking forward to the year ahead, here are our predictions for 2021:

![]() 1. Fiber investment will accelerate in Europe and the US, but rural hurdles will remain

1. Fiber investment will accelerate in Europe and the US, but rural hurdles will remain

Fiber investment will continue to be attractive at the macro level, with government targets and incentive program fueling interest. However, as seen in November’s UK spending review, we think the appetite for connecting the tricky last 20% of rural homes will be tested, and progress in this area will not be as fast as planned.

![]() 2. 5G consumer use cases will not prove game-changing (yet), so enterprise use cases will grow in importance

2. 5G consumer use cases will not prove game-changing (yet), so enterprise use cases will grow in importance

With service providers struggling to charge premiums for consumer 5G connectivity, more focus will be turned to the ways in which 5G investment can be monetized through enterprise use cases including private industrial networks and connectivity via private/public network slices.

![]() 3. 2021 will be the year that key questions around Low Earth Orbit (LEO) are answered

3. 2021 will be the year that key questions around Low Earth Orbit (LEO) are answered

After being awarded the best part of $1bn of FCC funding to make its broadband service available to 643,000 rural locations in the US, SpaceX’s Starlink must now prove that it has the business model to match. Does the service work as promised? Will the rural broadband cash give it the backing and economies of scale it needs to bring consumer CPE cost down to commercially viable levels? We think that 2021 will start to answer these questions.

![]() 4. ISPs will seek to differentiate on in-home reliability

4. ISPs will seek to differentiate on in-home reliability

Given the Covid-led transition to home-working, the requirement for improved in-home connectivity has increased which will see ISPs favor more robust home internet solutions, including faster speeds and enhanced security. With in-home connectivity presenting an increasingly important battleground, ISPs will seek to differentiate otherwise ‘vanilla’ broadband services.

![]() 5. Working from home changes will start to impact the enterprise telecoms market

5. Working from home changes will start to impact the enterprise telecoms market

With homeworking proving relatively successful in 2020, a trend will begin where traditional office spaces will become smaller and less important, as company office leases run out. Companies with lower office finance commitments will see an advantage that others will be tempted to follow. Key IT processes and storage will continue to move to the cloud, lowering requirements for in-office processes and traditional networking, with a knock-on impact on telco enterprise business models.

![]() 6. Telcos will face pressure to adopt digital service models

6. Telcos will face pressure to adopt digital service models

There will be a shift in the way that telcos traditionally serve their business customers – migrating from highly managed, high-cost interactions to digital self-service models. This trend started a few years ago but has been exacerbated by Covid, leading to an increasing demand for intuitive platforms from both consumer and business customers alike.

![]() 7. Streaming markets will begin to shift to bundled offers

7. Streaming markets will begin to shift to bundled offers

Streaming providers will look to evolve their offerings to overcome subscription fatigue, through bundled offers. The role of the bundler is still up for grabs, though traditional telcos and Pay TV providers remain in pole position, as seen by deals made by Discovery+ with Sky in the UK and Verizon in the US.

![]() 8. Data Science progress in TMT will continue to be made, but for large service providers, focus in 2021 will be on organizational readiness

8. Data Science progress in TMT will continue to be made, but for large service providers, focus in 2021 will be on organizational readiness

We often see that implementation and accessibility of AI and other Data Science capabilities is held back by organizational readiness, rather than by the technical possibilities. We will start to see this gap addressed through Data Governance programs that focus on driving value by providing clarity on “when” and “why” to use Data Science, rather than just “how”.

![]() 9. Fixed and mobile operators will continue to be taken private

9. Fixed and mobile operators will continue to be taken private

The trend seen this year of mid-tier fixed and mobile operators being taken private (e.g. CityFibre in the UK, Masmovil in Spain) will continue, as investment funds continue to see them as an attractive investment, with a 5- to 10-year exit strategy. The benefit for operators is more agility to take long-term investments (fiber and 5G) without having to justify quarter by quarter figures to the market.

![]() 10. Fixed-mobile consolidation to continue

10. Fixed-mobile consolidation to continue

An ongoing desire to consolidate fixed and mobile network assets (and customer bases) will see further M&A activity between fixed and mobile operators worldwide. In the UK, 2020 saw the announcement of the proposed merger between Virgin Media and O2 – assuming this goes ahead, we suspect this could trigger further consolidation in the UK market.

![]()

Do you agree with our predictions? What do you think 2021 will bring to the communications sector? Share your comments on our Year-End Letter with us .

![]()

Notes:

[1] https://www.nytimes.com/2020/03/28/us/testing-coronavirus-pandemic.html

[2] https://www.ftthcouncil.eu/documents/FTTH%20Council%20Europe

%20-%20Forecast%20for%20EUROPE%202020-2026%20AFTER%20COVID19%20-%20FINAL%20Published%20Version.pdf

[3] https://www.lightreading.com/services/fcc-moves-forward-with-rural-digital-opportunity-fund-auction-/d/d-id/761577

[4] https://docs.fcc.gov/public/attachments/DOC-368588A1.pdf

[5] https://www.ft.com/content/848c5b44-4d7a-11ea-95a0-43d18ec715f5

[6] https://www.reuters.com/article/us-swiss-5g-idUSKCN22420H

[7] https://telecoms.com/503745/europe-faces-a-new-epidemic-of-telecoms-mast-arson/

[8] https://news.sky.com/story/coronavirus-90-attacks-on-phone-masts-reported-during-uks-lockdown-11994401

[9] https://www.spglobal.com/marketintelligence/en/news-insights/blog/5g-survey-despite-covid-19-delays-operator-roadmaps-still-lead-to-5g

[10] https://gsacom.com/paper/5g-market-snapshot-november-2020-global-update/ and https://gsacom.com/paper/5g-market-snapshot-march-2020/

[11] https://about.att.com/story/2020/att_5g_nationwide.html

[12] https://www.researchandmarkets.com/reports/5157423/global-5g-tariff-tracker-q3-2020-edition

[13] https://futureiot.tech/sk-telecom-takes-5g-content-business-to-full-scale/

[14] https://www.lightreading.com/security/what-to-expect-from-c-band-auction-for-5g-spectrum/d/d-id/765917

[15] https://telecompetitor.com/clients/openvault/2020/Q2/LP/index.html

[16] https://www.ispreview.co.uk/index.php/2020/11/record-internet-traffic-surge-seen-by-some-uk-isps-on-tuesday.html

[17] https://www.thousandeyes.com/resources/internet-performance-report-covid-19-impact

[18] https://acaconnects.org/covid-19/broadband-dashboard/

[19] https://www.telecomtv.com/content/broadband/deutsche-telekoms-ip-migration-like-changing-tyres-at-full-speed-37927/

[20] https://www.ftthcouncil.eu/documents/2020%201202%20Copper_

switch-off_analysis_.pdf

[21] https://www.rapidtvnews.com/2020111659409/uk-svod-homes-grow-strongly-in-q3.html

[22] https://www.wsj.com/articles/coronavirus-lockdowns-lead-to-surge-in-digital-piracy-11587634202

[23] https://www.digitaltveurope.com/2020/10/15/salto-set-to-launch-with-three-subscription-offers/

[24] https://www.lefigaro.fr/medias/salto-a-seduit-100-000-utilisateurs-en-trois-semaines-20201118

[25] https://corporate.discovery.com/discovery-newsroom/discovery-announces-the-global-launch-of-discovery-the-definitive-streaming-service-for-the-best-real-life-entertainment-in-the-world-debuting-january-4-2021/

[26] https://www.broadbandtvnews.com/2020/10/12/research-avod-services-are-attracting-a-different-audience-to-svod/

[27] https://www.bbc.co.uk/news/business-55180055

[28] https://www.ispreview.co.uk/index.php/2020/05/virgin-media-and-o2-agree-uk-broadband-and-mobile-merger.html

[29] https://www.libertyglobal.com/liberty-global-completes-acquisition-of-sunrise/

[30] https://www.digitaltveurope.com/2019/11/13/sunrise-puts-end-to-upc-acquisition/

[31] https://www.theverge.com/2020/9/14/21435980/verizon-tracfone-acquisition-prepaid-phones-budget

[32] https://www.vodafone.com/news-and-media/vodafone-group-releases/news/merger-of-vodafone-italy-towers-into-inwit-completed

[33] https://www.lightreading.com/opticalip/its-fair-fibercop-says-europes-competition-watchdog/d/d-id/765726

[34] https://investors.zayo.com/news-and-events/press-releases/press-release-details/2020/Zayo-Completes-Transition-to-a-Private-Company/default.aspx

[35] https://www.commsupdate.com/articles/2020/06/12/stonepeak-completes-purchase-of-xplornet/

[36] https://www.reuters.com/article/deutsche-glasfaser-ma-eqt-idUSL8N2AA1KT

[37] https://www.capacitymedia.com/articles/3825319/altice-completes-sale-of-157bn-stake-in-ftth-wholesale-unit-to-morgan-stanley

[38] https://www.prnewswire.com/news-releases/global-household-fixed-wireless-access-fwa-subscribers-to-cross-half-a-billion-mark-by-2030-301108335.html

[39] https://www.verizon.com/about/investors/quarterly-reports/3q-2020-earnings-conference-call-webcast

[40] https://www.fiercewireless.com/operators/verizon-shrinks-5g-home-install-time-down-to-under-hour

[41] https://www2.deloitte.com/us/en/insights/industry/technology/5g-network-slicing.html

[42] https://www.lightreading.com/5g/atandt-t-mobile-verizon-prep-for-standalone-5g/d/d-id/762326

[43] https://www.5g-encode.com/5g-network-slicing-splicing-for-industry-4-0-use-cases

[44] http://www.bris.ac.uk/engineering/research/hpn/projects/5gencode/

[45] https://www.satelliteinternet.com/providers/starlink/

[46] https://www.inverse.com/innovation/spacex-starlink-musk-details-timeline

[47] https://www.rapidtvnews.com/2020111859421/us-pay-tv-losses-slow-down-in-q3.html#axzz6eKXkFzlk

[48] https://informitv.com/2020/07/31/charter-adds-100000-video-subscribers/

[49] https://investors.att.com/~/media/Files/A/ATT-IR/financial-reports/quarterly-earnings/2020/q3-2020/3Q20_Trending_Schedule.pdf

[50] https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-3rd-quarter-2020-results

[51] https://www.digitaltveurope.com/2020/08/21/uk-streaming-spend-rises-by-25-as-ott-rises-and-pay-tv-falls/

[52] https://cloud.google.com/explainable-ai

[53] https://www.ibm.com/watson/explainable-ai

[54] https://theconversation.com/amazon-echos-privacy-issues-go-way-beyond-voice-recordings-130016

[55] https://www.bbc.co.uk/news/technology-53770778

[56] https://www.forbes.com/sites/louiscolumbus/2020/04/05/2020-roundup-of-cybersecurity-forecasts-and-market-estimates/?sh=13851c86381d

[57] https://www.telefonica.com/en/web/press-office/-/telefonica-invests-in-nozomi-networks-a-leading-company-in-ot-and-iot-security

[58] https://www.brookings.edu/blog/techtank/2019/12/19/highlights-the-gdpr-and-ccpa-as-benchmarks-for-federal-privacy-legislation/

[59] https://www.endpointprotector.com/blog/data-protection-legislation-around-the-world-in-2020/

[60] https://m.globallegalpost.com/commentary/will-indias-new-data-protection-law-serve-as-a-government-surveillance-tool-4261027/

[61] https://www.pinsentmasons.com/out-law/news/uae-new-consumer-data-security-law-moves-closer

[62] https://www.newscientist.com/article/2220968-its-official-google-has-achieved-quantum-supremacy/

[63] https://www.technologyreview.com/2020/02/26/905777/google-ibm-quantum-supremacy-computing-feud/

[64] https://www.sciencemag.org/news/2020/07/biggest-flipping-challenge-quantum-computing

[65] https://www.gov.uk/government/news/huawei-to-be-removed-from-uk-5g-networks-by-2027

[66] https://www.ft.com/content/c460ce4c-c691-4df5-af49-47a395429fe8

[67] https://www.bbc.co.uk/news/technology-54104934

[68] https://techcrunch.com/2020/05/20/apple-and-google-launch-exposure-notification-api-enabling-public-health-authorities-to-release-apps

[69] https://www.xda-developers.com/google-apple-covid-19-contact-tracing-exposure-notifications-api-app-list-countries/